Summary

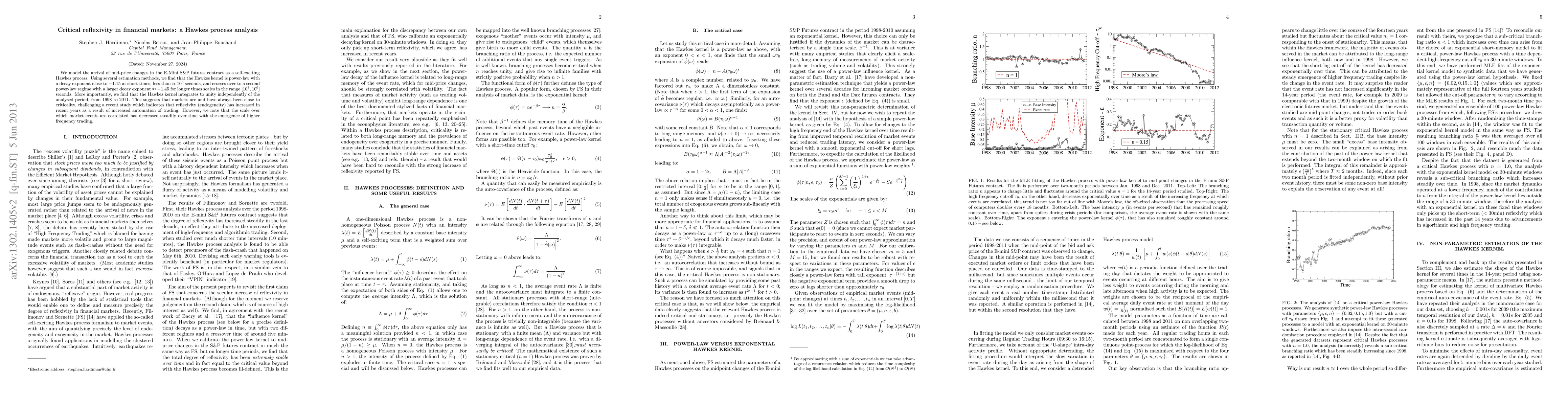

We model the arrival of mid-price changes in the E-Mini S&P futures contract as a self-exciting Hawkes process. Using several estimation methods, we find that the Hawkes kernel is power-law with a decay exponent close to -1.15 at short times, less than approximately 10^3 seconds, and crosses over to a second power-law regime with a larger decay exponent of approximately -1.45 for longer times scales in the range [10^3, 10^6] seconds. More importantly, we find that the Hawkes kernel integrates to unity independently of the analysed period, from 1998 to 2011. This suggests that markets are and have always been close to criticality, challenging a recent study which indicates that reflexivity (endogeneity) has increased in recent years as a result of increased automation of trading. However, we note that the scale over which market events are correlated has decreased steadily over time with the emergence of higher frequency trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVariance-Hawkes Process and its Application to Energy Markets

Anatoliy Swishchuk, Joshua McGillivray

| Title | Authors | Year | Actions |

|---|

Comments (0)