Summary

Financial markets across all asset classes are known to exhibit trends. These trends have been exploited by traders for decades. Here, we empirically measure when trends revert, based on 30 years of daily futures prices for equity indices, interest rates, currencies and commodities. We find that trends tend to revert once they reach a critical level of statistical significance. Based on polynomial regression, we carefully measure this critical level. We find that it is universal across asset classes and has a universal scaling behavior, as the trend's time horizon runs from a few days to several years. The corresponding regression coefficients are small, but statistically highly significant, as confirmed by bootstrapping and out-of-sample testing. Our results signal to investors when to exit a trend. They also reveal how markets have become more efficient over the decades. Moreover, they point towards a potential deep analogy between financial markets and critical phenomena: our analysis supports the conjecture that financial markets can be modeled as statistical mechanical ensembles of Buy/Sell orders near critical points. In this analogy, the trend strength plays the role of an order parameter, whose dynamcis is described by a Langevin equation with a quartic potential.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

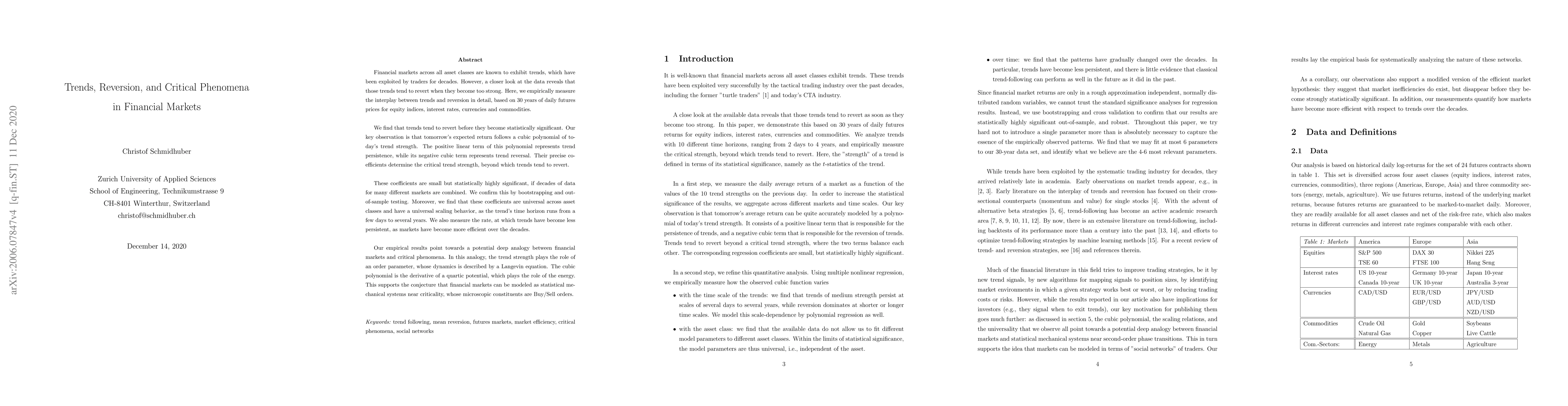

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrends and Reversion in Financial Markets on Time Scales from Minutes to Decades

Christof Schmidhuber, Sara A. Safari

Financial Markets and the Phase Transition between Water and Steam

Christof Schmidhuber

| Title | Authors | Year | Actions |

|---|

Comments (0)