Summary

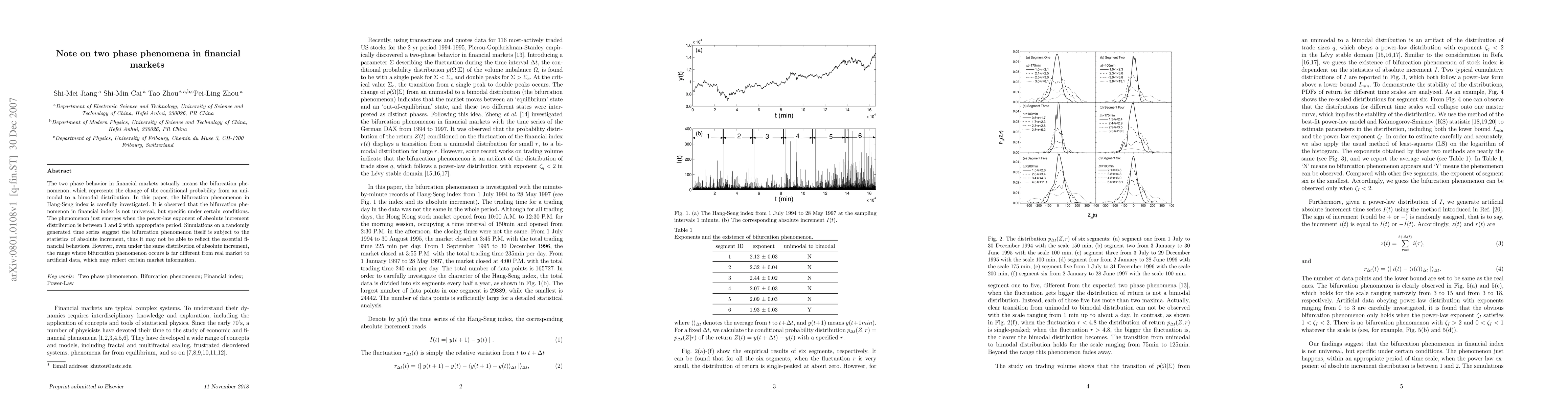

The two phase behavior in financial markets actually means the bifurcation phenomenon, which represents the change of the conditional probability from an unimodal to a bimodal distribution. In this paper, the bifurcation phenomenon in Hang-Seng index is carefully investigated. It is observed that the bifurcation phenomenon in financial index is not universal, but specific under certain conditions. The phenomenon just emerges when the power-law exponent of absolute increment distribution is between 1 and 2 with appropriate period. Simulations on a randomly generated time series suggest the bifurcation phenomenon itself is subject to the statistics of absolute increment, thus it may not be able to reflect the essential financial behaviors. However, even under the same distribution of absolute increment, the range where bifurcation phenomenon occurs is far different from real market to artificial data, which may reflect certain market information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)