Summary

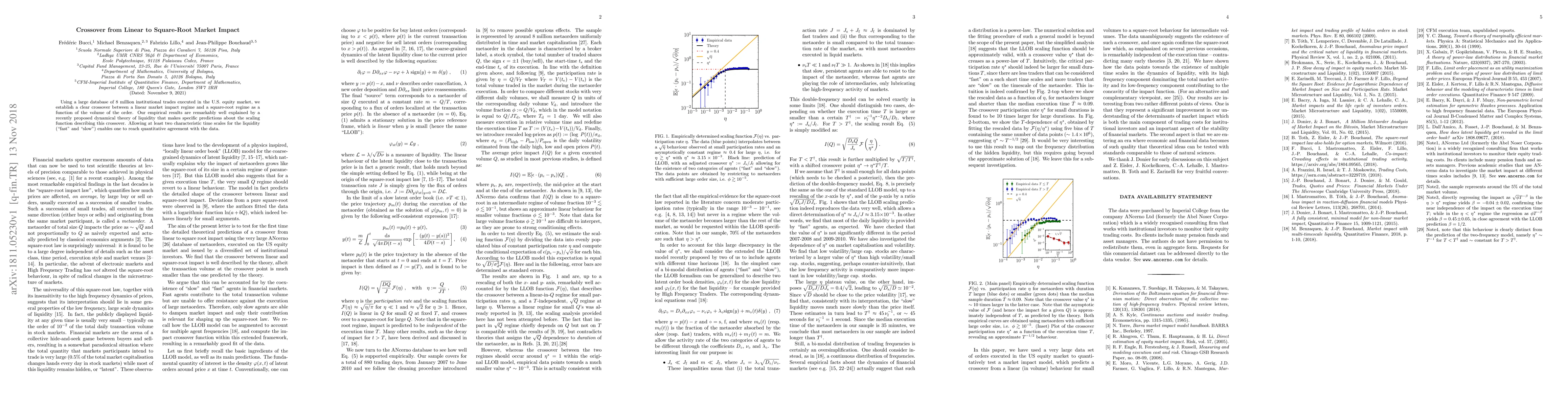

Using a large database of 8 million institutional trades executed in the U.S. equity market, we establish a clear crossover between a linear market impact regime and a square-root regime as a function of the volume of the order. Our empirical results are remarkably well explained by a recently proposed dynamical theory of liquidity that makes specific predictions about the scaling function describing this crossover. Allowing at least two characteristic time scales for the liquidity (`fast' and `slow') enables one to reach quantitative agreement with the data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe two square root laws of market impact and the role of sophisticated market participants

Mathieu Rosenbaum, Grégoire Szymanski, Bruno Durin

The "double" square-root law: Evidence for the mechanical origin of market impact using Tokyo Stock Exchange data

Jean-Philippe Bouchaud, Grégoire Loeper, Kiyoshi Kanazawa et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)