Summary

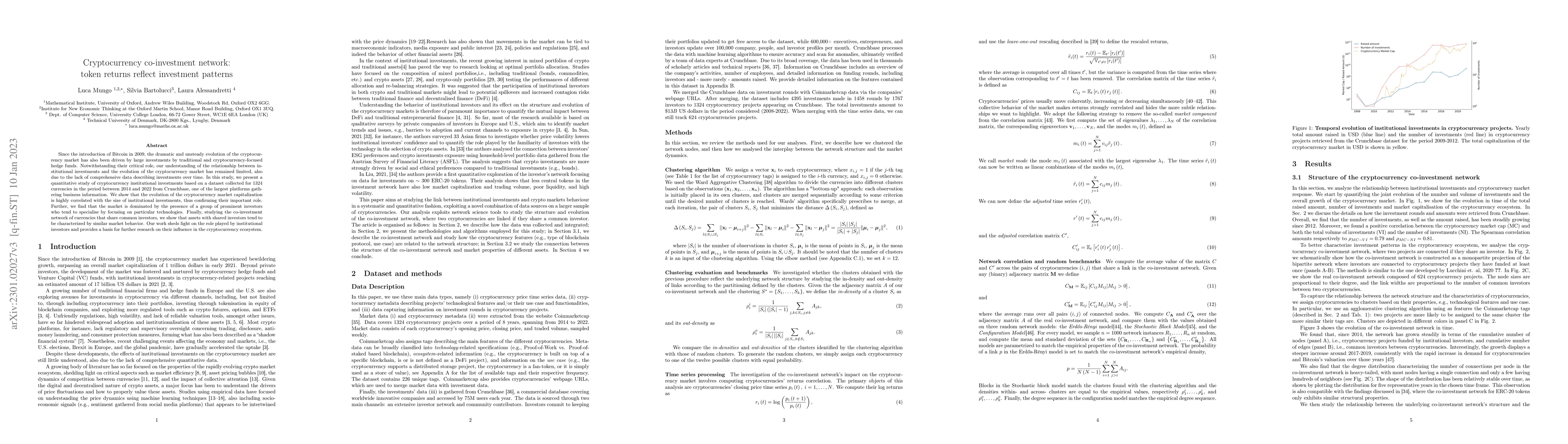

Since the introduction of Bitcoin in 2009, the dramatic and unsteady evolution of the cryptocurrency market has also been driven by large investments by traditional and cryptocurrency-focused hedge funds. Notwithstanding their critical role, our understanding of the relationship between institutional investments and the evolution of the cryptocurrency market has remained limited, also due to the lack of comprehensive data describing investments over time. In this study, we present a quantitative study of cryptocurrency institutional investments based on a dataset collected for 1324 currencies in the period between 2014 and 2022 from Crunchbase, one of the largest platforms gathering business information. We show that the evolution of the cryptocurrency market capitalization is highly correlated with the size of institutional investments, thus confirming their important role. Further, we find that the market is dominated by the presence of a group of prominent investors who tend to specialise by focusing on particular technologies. Finally, studying the co-investment network of currencies that share common investors, we show that assets with shared investors tend to be characterized by similar market behavior. Our work sheds light on the role played by institutional investors and provides a basis for further research on their influence in the cryptocurrency ecosystem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCoinvisor: An RL-Enhanced Chatbot Agent for Interactive Cryptocurrency Investment Analysis

Yanlin Wang, Chong Chen, Ting Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)