Authors

Summary

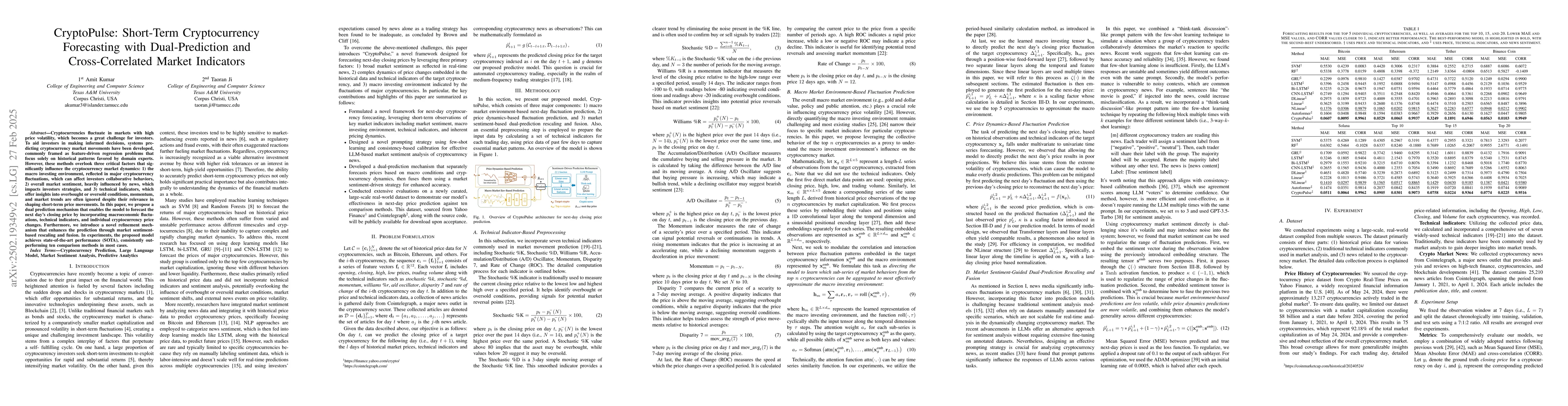

Cryptocurrencies fluctuate in markets with high price volatility, posing significant challenges for investors. To aid in informed decision-making, systems predicting cryptocurrency market movements have been developed, typically focusing on historical patterns. However, these methods often overlook three critical factors influencing market dynamics: 1) the macro investing environment, reflected in major cryptocurrency fluctuations affecting collaborative investor behaviors; 2) overall market sentiment, heavily influenced by news impacting investor strategies; and 3) technical indicators, offering insights into overbought or oversold conditions, momentum, and market trends, which are crucial for short-term price movements. This paper proposes a dual prediction mechanism that forecasts the next day's closing price by incorporating macroeconomic fluctuations, technical indicators, and individual cryptocurrency price changes. Additionally, a novel refinement mechanism enhances predictions through market sentiment-based rescaling and fusion. Experiments demonstrate that the proposed model achieves state-of-the-art performance, consistently outperforming ten comparison methods.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes CryptoPulse, a dual prediction mechanism for short-term cryptocurrency forecasting that incorporates macroeconomic fluctuations, technical indicators, and individual cryptocurrency price changes. It refines predictions using market sentiment-based rescaling and fusion.

Key Results

- CryptoPulse outperforms ten comparison methods in predicting next-day closing prices.

- The model consistently improves MAE and MSE across top individual cryptocurrencies and broader market trends.

- Ablation studies show that sentiment data significantly enhances forecasting performance.

- Technical indicators, when included, lead to improvements in model performance, especially for DLinear and Autoformer.

- CryptoPulse exhibits greater robustness with smaller standard deviations in MAE across multiple experiments.

Significance

This research is significant as it addresses the volatility challenges in cryptocurrency markets by proposing a comprehensive model that incorporates macroeconomic factors, technical indicators, and market sentiment, thereby providing more accurate short-term price predictions.

Technical Contribution

CryptoPulse introduces a dual prediction mechanism and a sentiment-guided rescaling and fusion technique, enhancing the accuracy of short-term cryptocurrency price forecasts.

Novelty

CryptoPulse distinguishes itself by integrating macroeconomic fluctuations, technical indicators, and market sentiment into a dual prediction framework, which outperforms existing methods in predicting cryptocurrency price movements.

Limitations

- The study is limited to a specific dataset and may not generalize to all cryptocurrencies or market conditions.

- Reliance on news sentiment analysis could introduce noise if not properly managed.

Future Work

- Explore the model's applicability to other volatile asset classes beyond cryptocurrencies.

- Investigate the impact of longer observation windows on prediction accuracy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom On-chain to Macro: Assessing the Importance of Data Source Diversity in Cryptocurrency Market Forecasting

Chryssis Georgiou, Giorgos Demosthenous, Eliada Polydorou

Cryptocurrency Price Forecasting Using XGBoost Regressor and Technical Indicators

Abdelatif Hafid, Maad Ebrahim, Ali Alfatemi et al.

DAM: A Universal Dual Attention Mechanism for Multimodal Timeseries Cryptocurrency Trend Forecasting

Luyao Zhang, Yihang Fu, Mingyu Zhou

Univariate and Multivariate LSTM Model for Short-Term Stock Market Prediction

Vishal Kuber, Divakar Yadav, Arun Kr Yadav

No citations found for this paper.

Comments (0)