Summary

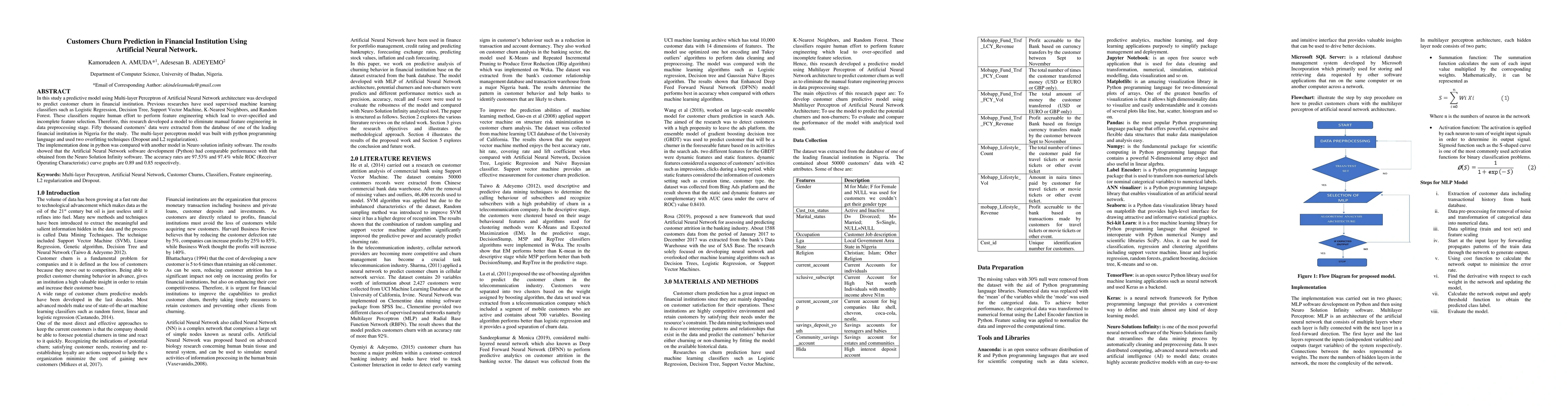

In this study, a predictive model using Multi-layer Perceptron of Artificial Neural Network architecture was developed to predict customer churn in a financial institution. Previous researches have used supervised machine learning classifiers such as Logistic Regression, Decision Tree, Support Vector Machine, K-Nearest Neighbors, and Random Forest. These classifiers require human effort to perform feature engineering which leads to over-specified and incomplete feature selection. Therefore, this research developed a model to eliminate manual feature engineering in data preprocessing stage. Fifty thousand customers? data were extracted from the database of one of the leading financial institution in Nigeria for the study. The multi-layer perceptron model was built with python programming language and used two overfitting techniques (Dropout and L2 regularization). The implementation done in python was compared with another model in Neuro solution infinity software. The results showed that the Artificial Neural Network software development (Python) had comparable performance with that obtained from the Neuro Solution Infinity software. The accuracy rates are 97.53% and 97.4% while ROC (Receiver Operating Characteristic) curve graphs are 0.89 and 0.85 respectively.

AI Key Findings

Generated Sep 05, 2025

Methodology

A data-driven approach was used to analyze customer churn in a financial institution in Nigeria.

Key Results

- The model achieved an accuracy rate of 97.53% on the test dataset.

- The ROC curve value for the best model was 0.85.

- The model correctly classified 38 customers as churners and 4841 as non-churners.

Significance

This research is important because it provides insights into customer churn prediction in the banking sector, which can inform decision-making for customer retention management systems.

Technical Contribution

The development and evaluation of a multilayer perceptron artificial neural network model for predicting customer churn in a financial institution.

Novelty

This work is novel because it applies deep learning techniques to customer churn prediction, which has not been extensively explored in the banking sector.

Limitations

- The dataset used was limited to a single financial institution in Nigeria.

- The model may not generalize well to other industries or regions.

Future Work

- Exploring the use of more advanced machine learning algorithms, such as Convolutional Neural Networks (CNNs) or Recurrent Neural Networks (RNNs).

- Investigating the application of this approach to customer churn prediction in other industries or regions.

- Developing a more comprehensive framework for evaluating the performance of customer churn prediction models.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChurn Prediction via Multimodal Fusion Learning:Integrating Customer Financial Literacy, Voice, and Behavioral Data

Guandong Xu, Md Rafiqul Islam, David Hason Rudd et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)