Summary

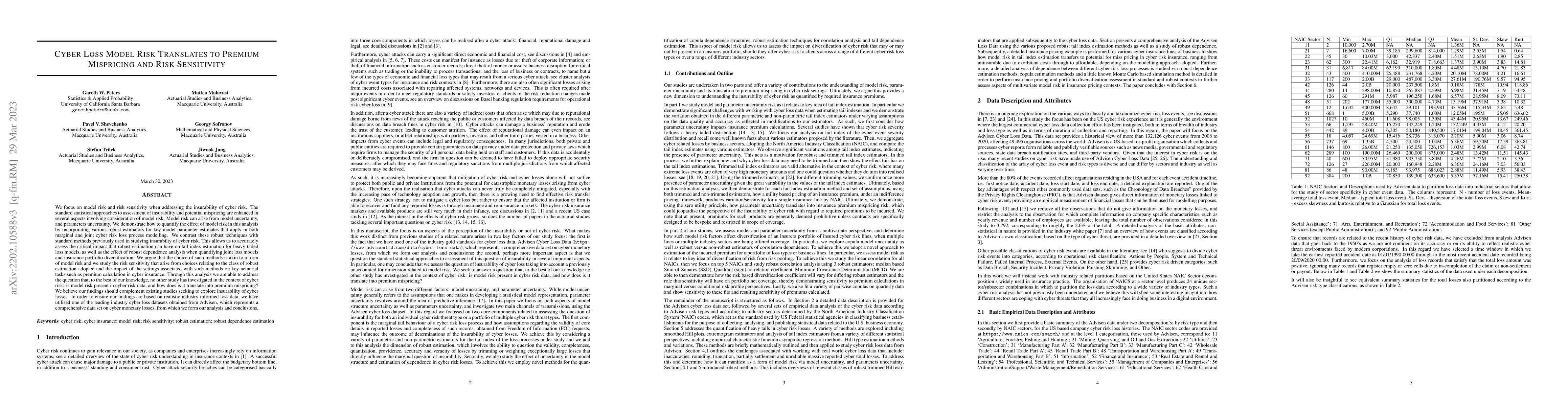

We focus on model risk and risk sensitivity when addressing the insurability of cyber risk. The standard statistical approaches to assessment of insurability and potential mispricing are enhanced in several aspects involving consideration of model risk. Model risk can arise from model uncertainty, and parameters uncertainty. We demonstrate how to quantify the effect of model risk in this analysis by incorporating various robust estimators for key model parameter estimates that apply in both marginal and joint cyber risk loss process modelling. We contrast these robust techniques with standard methods previously used in studying insurabilty of cyber risk. This allows us to accurately assess the critical impact that robust estimation can have on tail index estimation for heavy tailed loss models, as well as the effect of robust dependence analysis when quantifying joint loss models and insurance portfolio diversification. We argue that the choice of such methods is akin to a form of model risk and we study the risk sensitivity that arise from choices relating to the class of robust estimation adopted and the impact of the settings associated with such methods on key actuarial tasks such as premium calculation in cyber insurance. Through this analysis we are able to address the question that, to the best of our knowledge, no other study has investigated in the context of cyber risk: is model risk present in cyber risk data, and how does is it translate into premium mispricing? We believe our findings should complement existing studies seeking to explore insurability of cyber losses. In order to ensure our findings are based on realistic industry informed loss data, we have utilised one of the leading industry cyber loss datasets obtained from Advisen, which represents a comprehensive data set on cyber monetary losses, from which we form our analysis and conclusions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCyber Risk Frequency, Severity and Insurance Viability

Georgy Sofronov, Gareth W. Peters, Matteo Malavasi et al.

A Bonus-Malus Framework for Cyber Risk Insurance and Optimal Cybersecurity Provisioning

Anwitaman Datta, Ariel Neufeld, Gareth W. Peters et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)