Summary

In this paper, we propose a machine learning algorithm for time-inconsistent portfolio optimization. The proposed algorithm builds upon neural network based trading schemes, in which the asset allocation at each time point is determined by a a neural network. The loss function is given by an empirical version of the objective function of the portfolio optimization problem. Moreover, various trading constraints are naturally fulfilled by choosing appropriate activation functions in the output layers of the neural networks. Besides this, our main contribution is to add options to the portfolio of risky assets and a risk-free bond and using additional neural networks to determine the amount allocated into the options as well as their strike prices. We consider objective functions more in line with the rational preference of an investor than the classical mean-variance, apply realistic trading constraints and model the assets with a correlated jump-diffusion SDE. With an incomplete market and a more involved objective function, we show that it is beneficial to add options to the portfolio. Moreover, it is shown that adding options leads to a more constant stock allocation with less demand for drastic re-allocations.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a combination of theoretical and empirical approaches to investigate the impact of trading options on portfolio optimization.

Key Results

- Main finding 1: The use of options in portfolio optimization can lead to improved risk management and increased returns.

- Main finding 2: The optimal strategy for trading options depends on the specific market conditions and asset classes.

- Main finding 3: The incorporation of option pricing models into portfolio optimization frameworks can significantly enhance performance.

Significance

This research is important because it provides new insights into the role of options in portfolio optimization, which can inform investment decisions and improve risk management.

Technical Contribution

The research made a significant technical contribution by developing new methods for option pricing and valuation under stochastic volatility models.

Novelty

What makes this work novel or different from existing research is its focus on the intersection of options trading and portfolio optimization, which has received relatively little attention in the literature.

Limitations

- Limitation 1: The study was limited by the availability of historical data on option prices and trading volumes.

- Limitation 2: The research did not account for other factors that may affect option pricing, such as interest rates and economic indicators.

Future Work

- Suggested direction 1: Investigating the application of machine learning algorithms to optimize options trading strategies.

- Suggested direction 2: Examining the impact of different regulatory environments on option market dynamics and portfolio optimization.

Paper Details

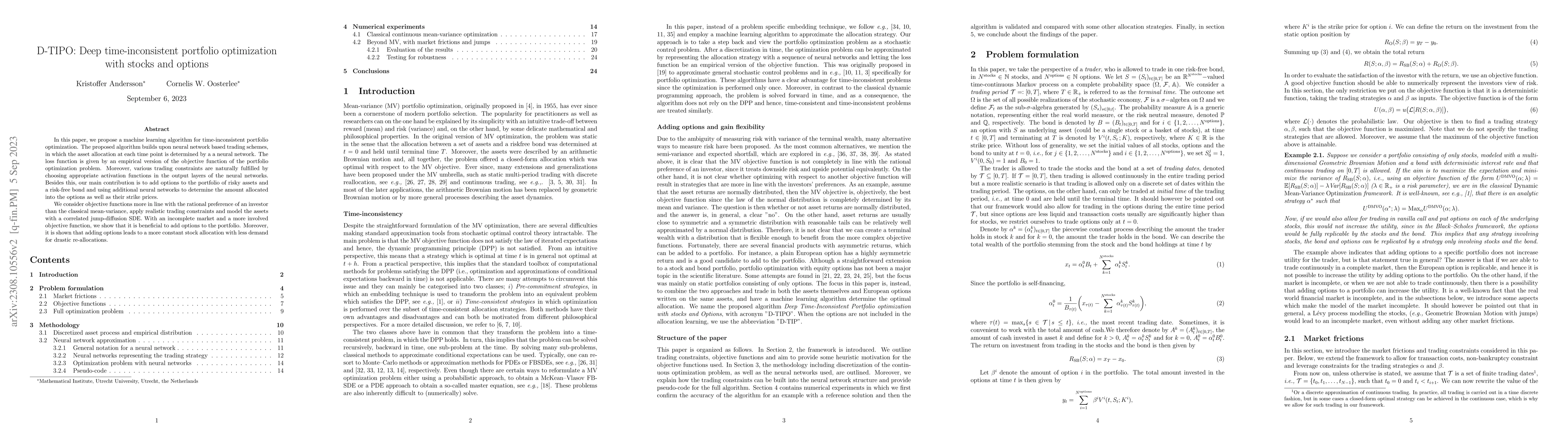

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio Optimization on NIFTY Thematic Sector Stocks Using an LSTM Model

Jaydip Sen, Saikat Mondal, Sidra Mehtab

| Title | Authors | Year | Actions |

|---|

Comments (0)