Authors

Summary

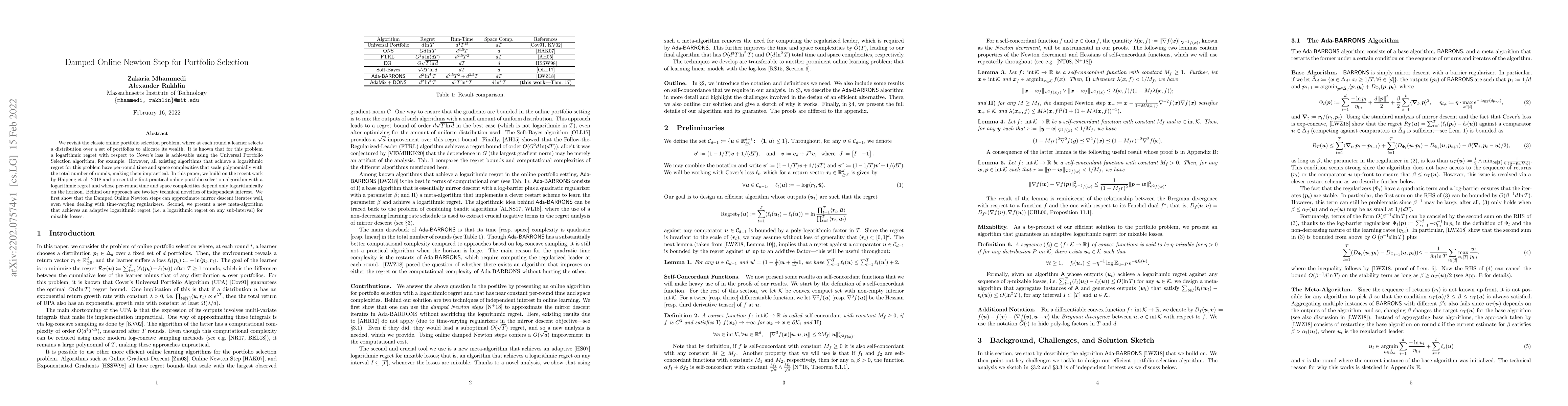

We revisit the classic online portfolio selection problem, where at each round a learner selects a distribution over a set of portfolios to allocate its wealth. It is known that for this problem a logarithmic regret with respect to Cover's loss is achievable using the Universal Portfolio Selection algorithm, for example. However, all existing algorithms that achieve a logarithmic regret for this problem have per-round time and space complexities that scale polynomially with the total number of rounds, making them impractical. In this paper, we build on the recent work by Haipeng et al. 2018 and present the first practical online portfolio selection algorithm with a logarithmic regret and whose per-round time and space complexities depend only logarithmically on the horizon. Behind our approach are two key technical novelties of independent interest. We first show that the Damped Online Newton steps can approximate mirror descent iterates well, even when dealing with time-varying regularizers. Second, we present a new meta-algorithm that achieves an adaptive logarithmic regret (i.e. a logarithmic regret on any sub-interval) for mixable losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient and Near-Optimal Online Portfolio Selection

Pierre Gaillard, Dmitrii M. Ostrovskii, Rémi Jézéquel

| Title | Authors | Year | Actions |

|---|

Comments (0)