Summary

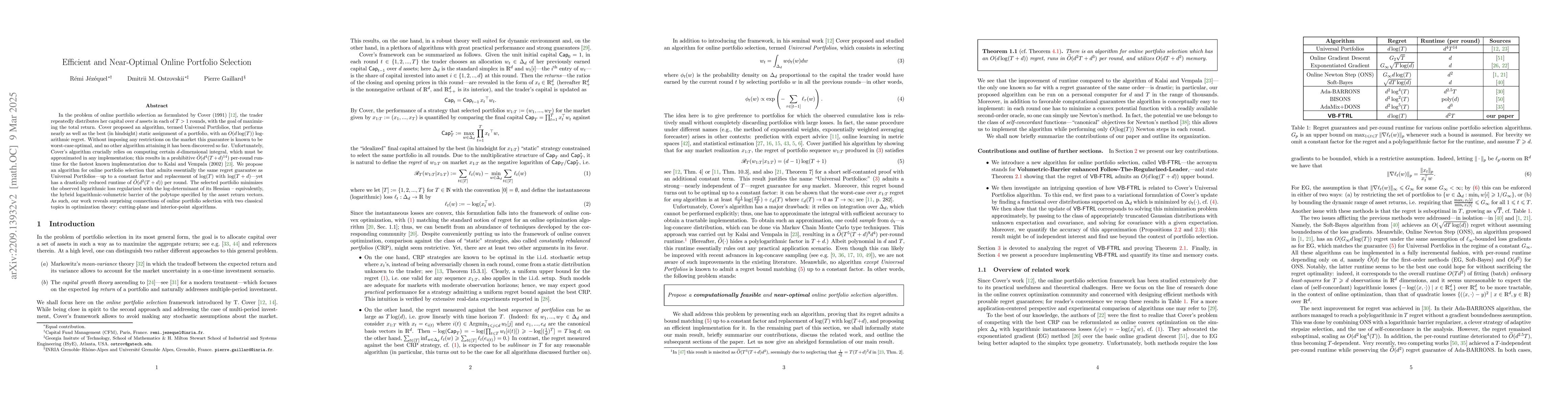

In the problem of online portfolio selection as formulated by Cover (1991), the trader repeatedly distributes her capital over $ d $ assets in each of $ T > 1 $ rounds, with the goal of maximizing the total return. Cover proposed an algorithm, termed Universal Portfolios, that performs nearly as well as the best (in hindsight) static assignment of a portfolio, with an $ O(d\log(T)) $ regret in terms of the logarithmic return. Without imposing any restrictions on the market this guarantee is known to be worst-case optimal, and no other algorithm attaining it has been discovered so far. Unfortunately, Cover's algorithm crucially relies on computing certain $ d $-dimensional integral which must be approximated in any implementation; this results in a prohibitive $ \tilde O(d^4(T+d)^{14}) $ per-round runtime for the fastest known implementation due to Kalai and Vempala (2002). We propose an algorithm for online portfolio selection that admits essentially the same regret guarantee as Universal Portfolios -- up to a constant factor and replacement of $ \log(T) $ with $ \log(T+d) $ -- yet has a drastically reduced runtime of $ \tilde O(d^2(T+d)) $ per round. The selected portfolio minimizes the current logarithmic loss regularized by the log-determinant of its Hessian -- equivalently, the hybrid logarithmic-volumetric barrier of the polytope specified by the asset return vectors. As such, our work reveals surprising connections of online portfolio selection with two classical topics in optimization theory: cutting-plane and interior-point algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDamped Online Newton Step for Portfolio Selection

Alexander Rakhlin, Zakaria Mhammedi

Adaptive Robust Online Portfolio Selection

Hoi Ying Wong, Tony Sit, Man Yiu Tsang

| Title | Authors | Year | Actions |

|---|

Comments (0)