Authors

Summary

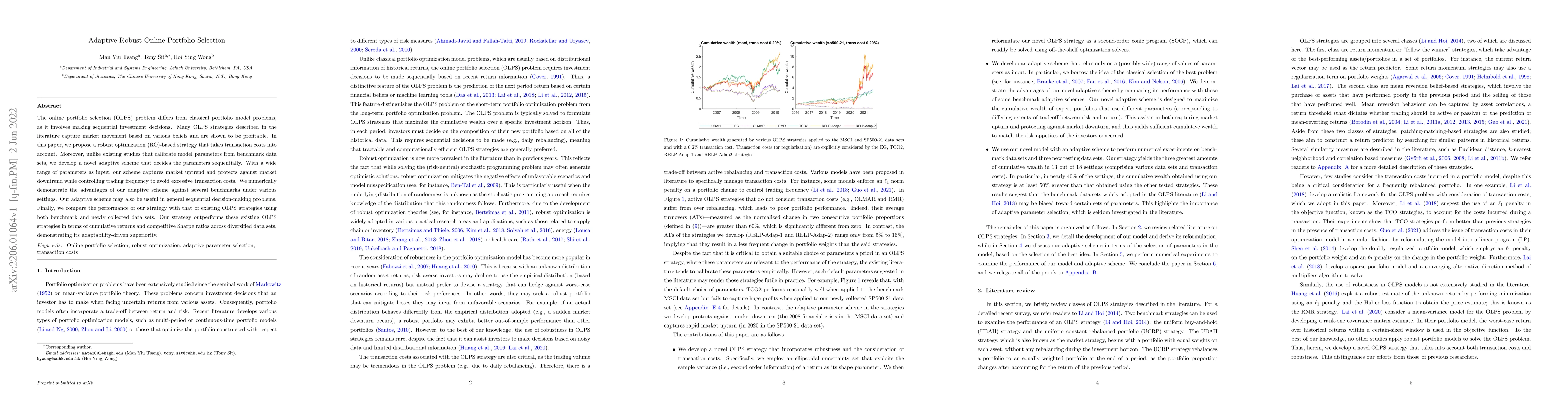

The online portfolio selection (OLPS) problem differs from classical portfolio model problems, as it involves making sequential investment decisions. Many OLPS strategies described in the literature capture market movement based on various beliefs and are shown to be profitable. In this paper, we propose a robust optimization (RO)-based strategy that takes transaction costs into account. Moreover, unlike existing studies that calibrate model parameters from benchmark data sets, we develop a novel adaptive scheme that decides the parameters sequentially. With a wide range of parameters as input, our scheme captures market uptrend and protects against market downtrend while controlling trading frequency to avoid excessive transaction costs. We numerically demonstrate the advantages of our adaptive scheme against several benchmarks under various settings. Our adaptive scheme may also be useful in general sequential decision-making problems. Finally, we compare the performance of our strategy with that of existing OLPS strategies using both benchmark and newly collected data sets. Our strategy outperforms these existing OLPS strategies in terms of cumulative returns and competitive Sharpe ratios across diversified data sets, demonstrating its adaptability-driven superiority.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDamped Online Newton Step for Portfolio Selection

Alexander Rakhlin, Zakaria Mhammedi

| Title | Authors | Year | Actions |

|---|

Comments (0)