Authors

Summary

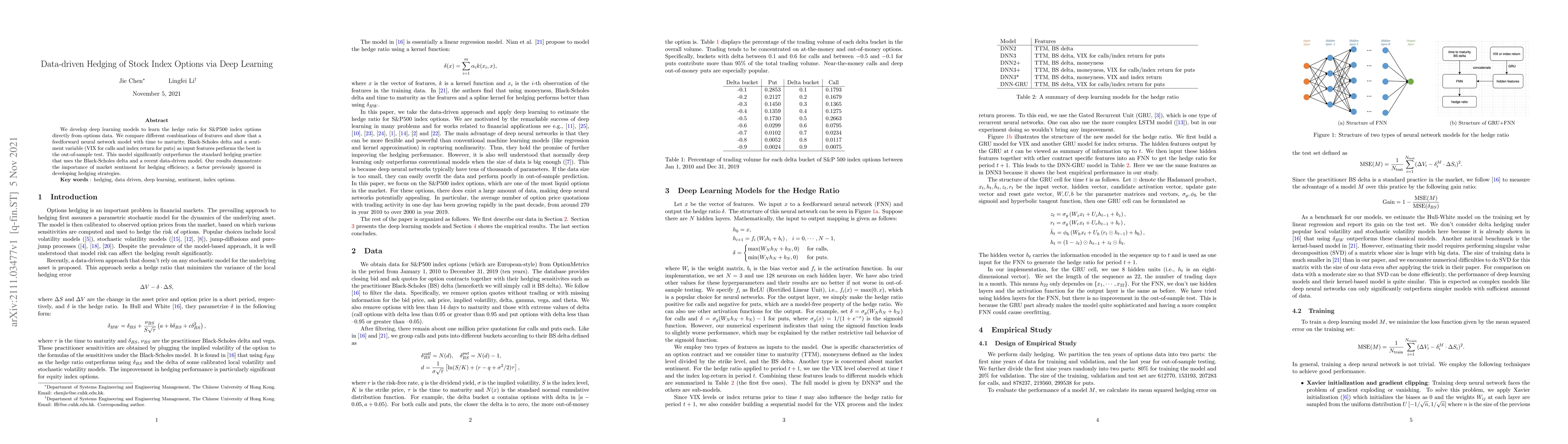

We develop deep learning models to learn the hedge ratio for S&P500 index options directly from options data. We compare different combinations of features and show that a feedforward neural network model with time to maturity, Black-Scholes delta and a sentiment variable (VIX for calls and index return for puts) as input features performs the best in the out-of-sample test. This model significantly outperforms the standard hedging practice that uses the Black-Scholes delta and a recent data-driven model. Our results demonstrate the importance of market sentiment for hedging efficiency, a factor previously ignored in developing hedging strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData-driven Approach for Static Hedging of Exchange Traded Options

Vikranth Lokeshwar Dhandapani, Shashi Jain

Efficient Learning of Nested Deep Hedging using Multiple Options

Masanori Hirano, Kentaro Imajo, Kentaro Minami et al.

Enhancing Black-Scholes Delta Hedging via Deep Learning

Chunhui Qiao, Xiangwei Wan

Construction and Hedging of Equity Index Options Portfolios

Robert Ślepaczuk, Maciej Wysocki

| Title | Authors | Year | Actions |

|---|

Comments (0)