Authors

Summary

Mean-variance optimization (MVO) is known to be sensitive to estimation error in its inputs. Norm penalization of MVO programs is a regularization technique that can mitigate the adverse effects of estimation error. We augment the standard MVO program with a convex combination of parameterized $L_1$ and $L_2$-norm penalty functions. The resulting program is a parameterized quadratic program (QP) whose dual is a box-constrained QP. We make use of recent advances in neural network architecture for differentiable QPs and present a data-driven framework for optimizing parameterized norm-penalties to minimize the downstream MVO objective. We present a novel technique for computing the derivative of the optimal primal solution with respect to the parameterized $L_1$-norm penalty by implicit differentiation of the dual program. The primal solution is then recovered from the optimal dual variables. Historical simulations using US stocks and global futures data demonstrate the benefit of the data-driven optimization approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

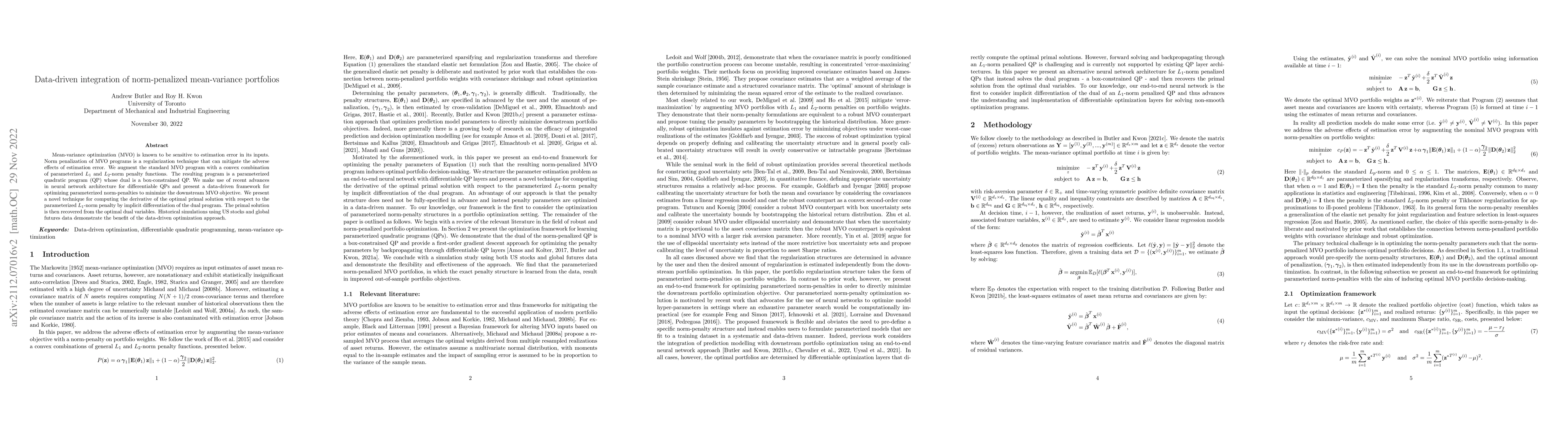

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean-Variance Efficiency of Optimal Power and Logarithmic Utility Portfolios

Taras Bodnar, Nestor Parolya, Dmytro Ivasiuk et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)