Authors

Summary

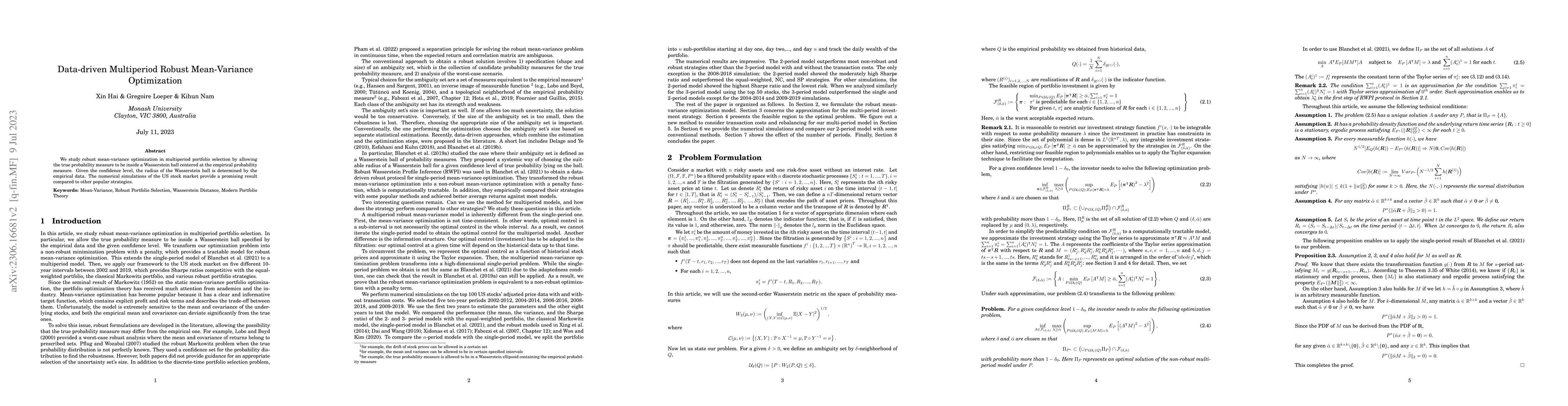

We study robust mean-variance optimization in multiperiod portfolio selection by allowing the true probability measure to be inside a Wasserstein ball centered at the empirical probability measure. Given the confidence level, the radius of the Wasserstein ball is determined by the empirical data. The numerical simulations of the US stock market provide a promising result compared to other popular strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCounterfactual Mean-variance Optimization

Kwangho Kim, Alan Mishler, José R. Zubizarreta

Data-driven integration of norm-penalized mean-variance portfolios

Andrew Butler, Roy H. Kwon

No citations found for this paper.

Comments (0)