Summary

We propose three different data-driven approaches for pricing European-style call options using supervised machine-learning algorithms. These approaches yield models that give a range of fair prices instead of a single price point. The performance of the models are tested on two stock market indices: NIFTY$50$ and BANKNIFTY from the Indian equity market. Although neither historical nor implied volatility is used as an input, the results show that the trained models have been able to capture the option pricing mechanism better than or similar to the Black-Scholes formula for all the experiments. Our choice of scale free I/O allows us to train models using combined data of multiple different assets from a financial market. This not only allows the models to achieve far better generalization and predictive capability, but also solves the problem of paucity of data, the primary limitation of using machine learning techniques. We also illustrate the performance of the trained models in the period leading up to the 2020 Stock Market Crash (Jan 2019 to April 2020).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

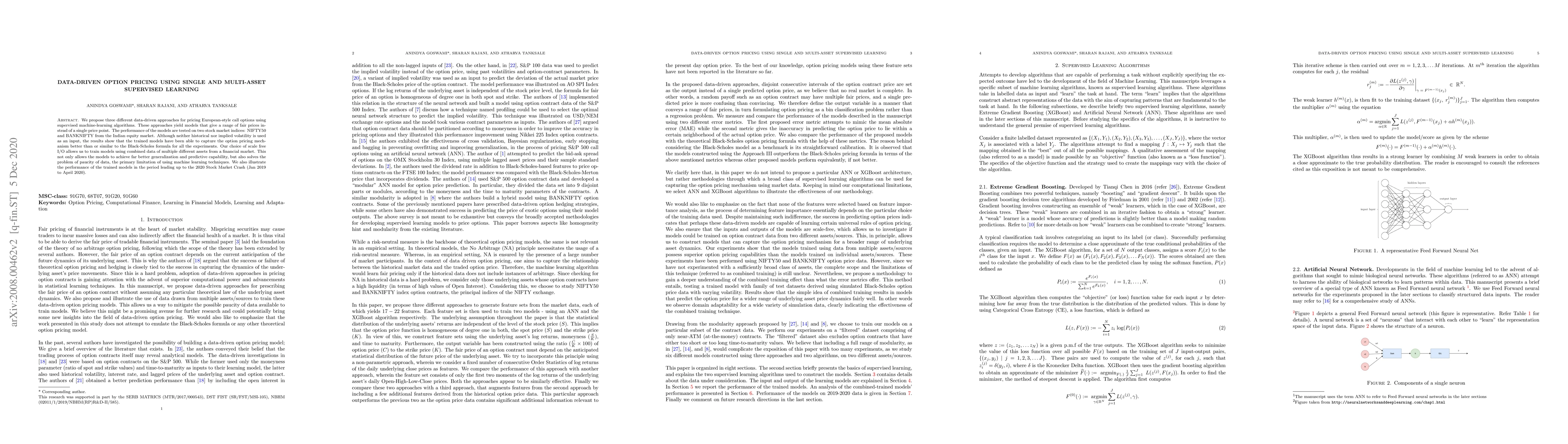

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)