Authors

Summary

Given a finite collection of stochastic alternatives, we study the problem of sequentially allocating a fixed sampling budget to identify the optimal alternative with a high probability, where the optimal alternative is defined as the one with the smallest value of extreme tail risk. We particularly consider a situation where these alternatives generate heavy-tailed losses whose probability distributions are unknown and may not admit any specific parametric representation. In this setup, we propose data-driven sequential sampling policies that maximize the rate at which the likelihood of falsely selecting suboptimal alternatives decays to zero. We rigorously demonstrate the superiority of the proposed methods over existing approaches, which is further validated via numerical studies.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes data-driven sequential sampling policies for identifying the optimal alternative with the smallest value of extreme tail risk, considering heavy-tailed losses with unknown distributions. It introduces new criteria for selecting the optimal alternative and demonstrates their superiority over standard criteria in extreme-risk, large-sample regimes.

Key Results

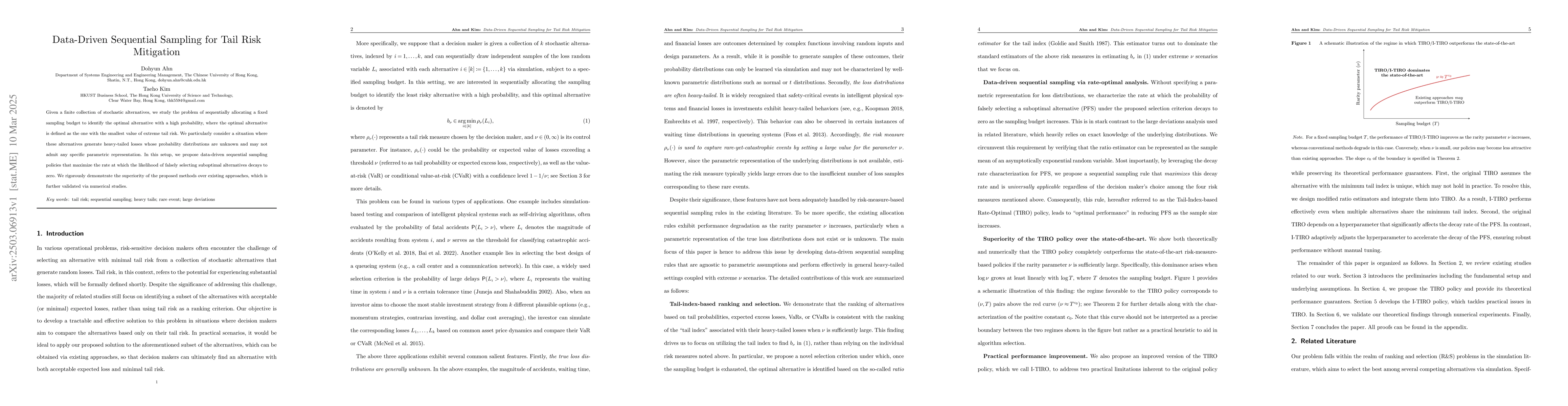

- Proposed data-driven sequential sampling policies outperform existing approaches in identifying the optimal alternative.

- The new selection criteria based on estimators (17) clearly outperform standard estimators in identifying the optimal alternative, regardless of tie cases.

- The modified selection criterion leads to the selection of the optimal alternative even in tie cases, provided sufficient loss samples are generated from each alternative.

- The decay rates of PFS for the new estimators are at least as fast as those for the ratio estimators, showing the preference of the modified selection criterion over the original one, even without tie cases.

- For large T, PFS for the new estimators is approximately bounded from above by exp(-TδG(α)).

Significance

This research is significant as it provides a methodological framework to address the challenges of heavy-tailed losses with unknown distributions, emphasizing tail risk associated with rare events, which is crucial in risk-sensitive decision-making across various fields including testing intelligent physical systems, selecting queueing system designs, and choosing investment strategies.

Technical Contribution

The paper introduces new data-driven sequential sampling policies and selection criteria that asymptotically maximize decay rates in data-driven environments, significantly enhancing the selection of the optimal alternative based on extreme tail risk.

Novelty

This work is novel as it's the first methodological framework to address the identification of optimal alternatives under heavy-tailed losses with unknown distributions, focusing on tail risk associated with rare events, and it rigorously verifies the superiority of the proposed criteria over standard ones in extreme-risk, large-sample regimes.

Limitations

- The choice of hyperparameters for I-TIRO, particularly the impact and data-driven calibration of δt and u, deserves further investigation as they heavily influence the prediction quality of the modified estimators.

- The current approach does not work for light-tailed distributions as Assumption 1 no longer holds, and their asymptotic tail behaviors are more complex to analyze.

Future Work

- Investigate the impact and data-driven calibration of δt and u for I-TIRO to enhance prediction quality.

- Extend the approach to a different class of distributions, such as subexponential distributions, for loss distributions that are light-tailed.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)