Summary

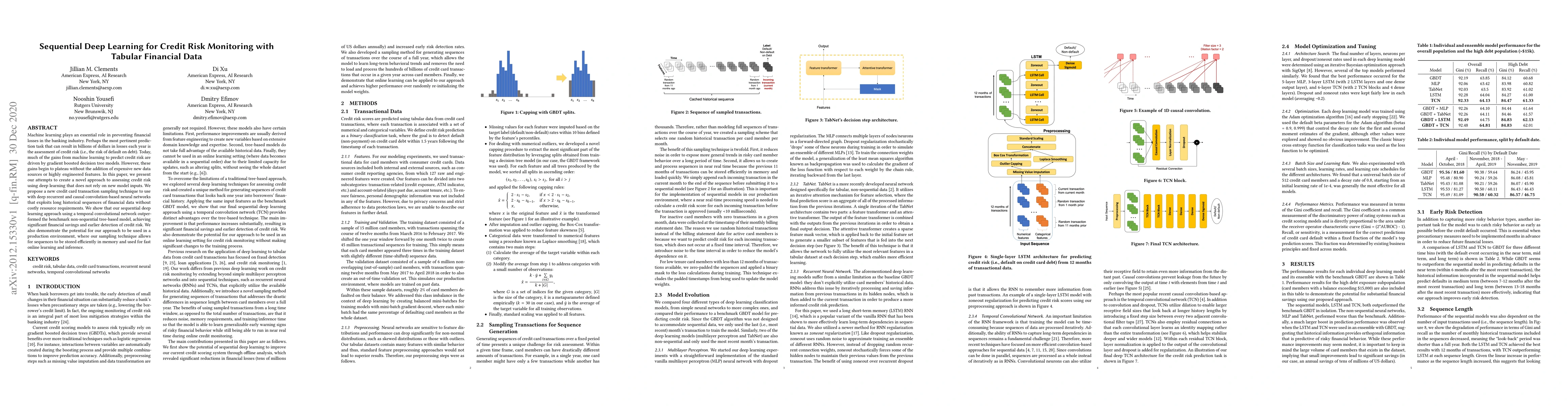

Machine learning plays an essential role in preventing financial losses in the banking industry. Perhaps the most pertinent prediction task that can result in billions of dollars in losses each year is the assessment of credit risk (i.e., the risk of default on debt). Today, much of the gains from machine learning to predict credit risk are driven by gradient boosted decision tree models. However, these gains begin to plateau without the addition of expensive new data sources or highly engineered features. In this paper, we present our attempts to create a novel approach to assessing credit risk using deep learning that does not rely on new model inputs. We propose a new credit card transaction sampling technique to use with deep recurrent and causal convolution-based neural networks that exploits long historical sequences of financial data without costly resource requirements. We show that our sequential deep learning approach using a temporal convolutional network outperformed the benchmark non-sequential tree-based model, achieving significant financial savings and earlier detection of credit risk. We also demonstrate the potential for our approach to be used in a production environment, where our sampling technique allows for sequences to be stored efficiently in memory and used for fast online learning and inference.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinLangNet: A Novel Deep Learning Framework for Credit Risk Prediction Using Linguistic Analogy in Financial Data

Zixuan Wang, Chu Liu, Tongyao Wang et al.

DeRisk: An Effective Deep Learning Framework for Credit Risk Prediction over Real-World Financial Data

Yi Hu, Hui Li, Yi Wu et al.

TabSeq: A Framework for Deep Learning on Tabular Data via Sequential Ordering

Gianfranco Doretto, Mary-Anne Hartley, Kesheng Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)