Summary

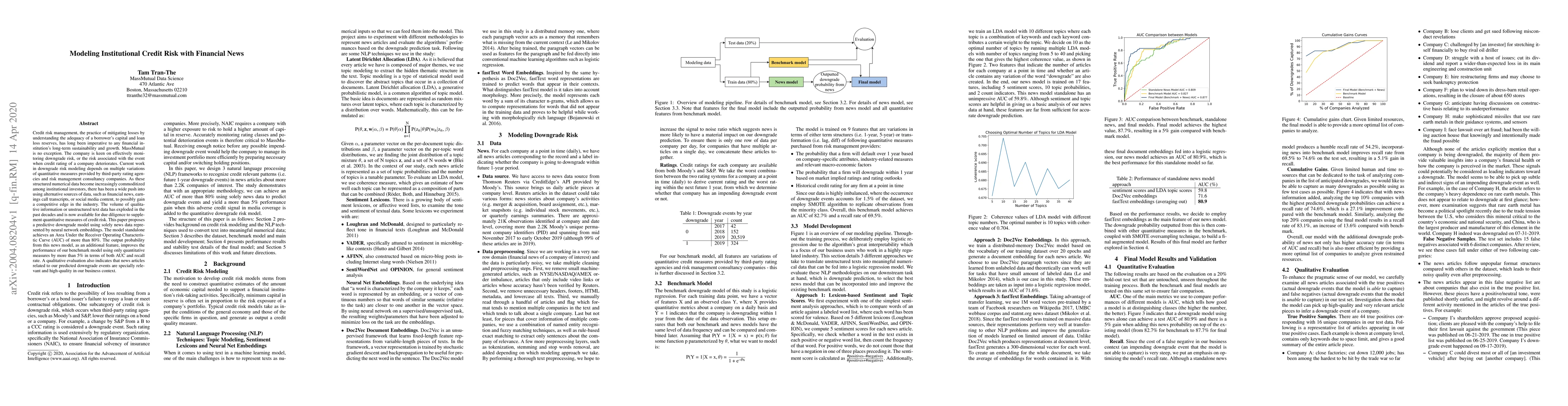

Credit risk management, the practice of mitigating losses by understanding the adequacy of a borrower's capital and loan loss reserves, has long been imperative to any financial institution's long-term sustainability and growth. MassMutual is no exception. The company is keen on effectively monitoring downgrade risk, or the risk associated with the event when credit rating of a company deteriorates. Current work in downgrade risk modeling depends on multiple variations of quantitative measures provided by third-party rating agencies and risk management consultancy companies. As these structured numerical data become increasingly commoditized among institutional investors, there has been a wide push into using alternative sources of data, such as financial news, earnings call transcripts, or social media content, to possibly gain a competitive edge in the industry. The volume of qualitative information or unstructured text data has exploded in the past decades and is now available for due diligence to supplement quantitative measures of credit risk. This paper proposes a predictive downgrade model using solely news data represented by neural network embeddings. The model standalone achieves an Area Under the Receiver Operating Characteristic Curve (AUC) of more than 80 percent. The output probability from this news model, as an additional feature, improves the performance of our benchmark model using only quantitative measures by more than 5 percent in terms of both AUC and recall rate. A qualitative evaluation also indicates that news articles related to our predicted downgrade events are specially relevant and high-quality in our business context.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)