Summary

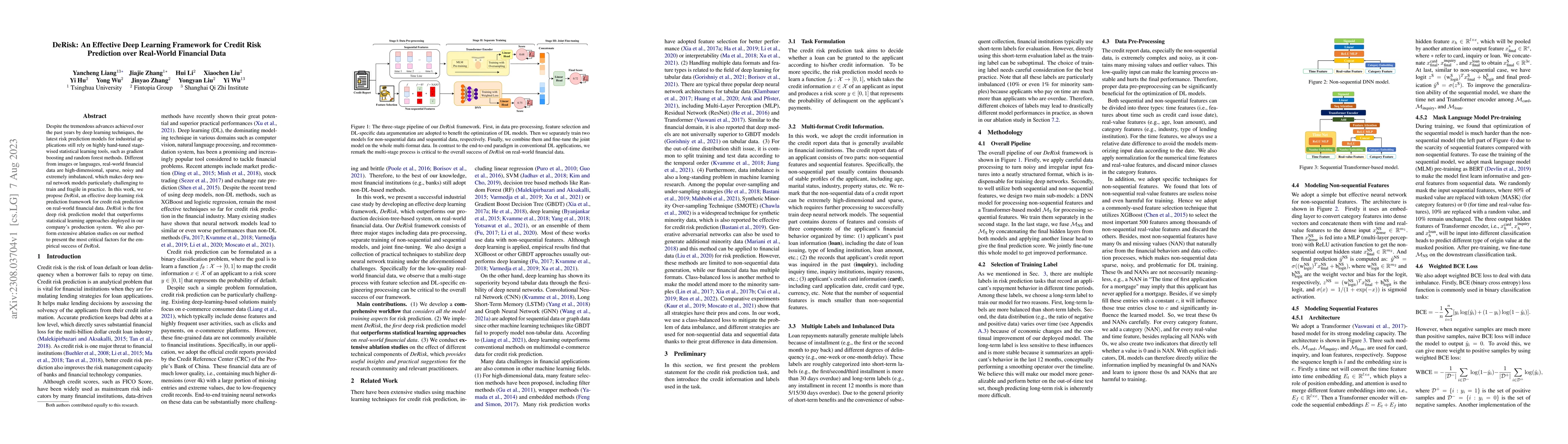

Despite the tremendous advances achieved over the past years by deep learning techniques, the latest risk prediction models for industrial applications still rely on highly handtuned stage-wised statistical learning tools, such as gradient boosting and random forest methods. Different from images or languages, real-world financial data are high-dimensional, sparse, noisy and extremely imbalanced, which makes deep neural network models particularly challenging to train and fragile in practice. In this work, we propose DeRisk, an effective deep learning risk prediction framework for credit risk prediction on real-world financial data. DeRisk is the first deep risk prediction model that outperforms statistical learning approaches deployed in our company's production system. We also perform extensive ablation studies on our method to present the most critical factors for the empirical success of DeRisk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinLangNet: A Novel Deep Learning Framework for Credit Risk Prediction Using Linguistic Analogy in Financial Data

Zixuan Wang, Chu Liu, Tongyao Wang et al.

An Integrated Machine Learning and Deep Learning Framework for Credit Card Approval Prediction

Yijing Wei, Yanxin Shen, Yujian Long et al.

Analysis of Financial Risk Behavior Prediction Using Deep Learning and Big Data Algorithms

Zhaoyang Zhang, Haowei Yang, Ao Xiang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)