Authors

Summary

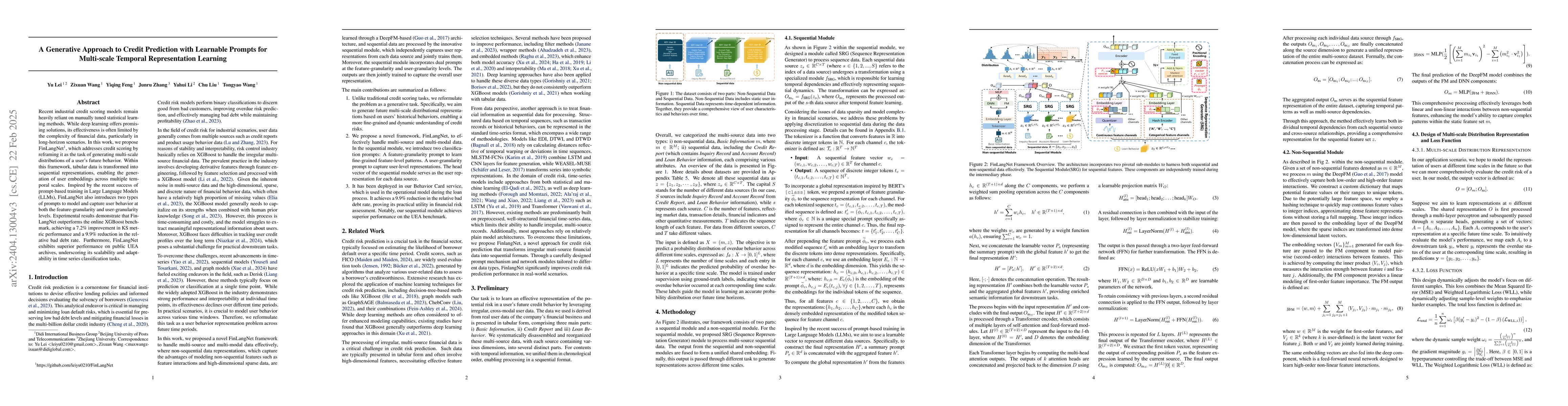

Recent industrial applications in risk prediction still heavily rely on extensively manually-tuned, statistical learning methods. Real-world financial data, characterized by its high dimensionality, sparsity, high noise levels, and significant imbalance, poses unique challenges for the effective application of deep neural network models. In this work, we introduce a novel deep learning risk prediction framework, FinLangNet, which conceptualizes credit loan trajectories in a structure that mirrors linguistic constructs. This framework is tailored for credit risk prediction using real-world financial data, drawing on structural similarities to language by adapting natural language processing techniques. It particularly emphasizes analyzing the development and forecastability of mid-term credit histories through multi-head and sequences of detailed financial events. Our research demonstrates that FinLangNet surpasses traditional statistical methods in predicting credit risk and that its integration with these methods enhances credit overdue prediction models, achieving a significant improvement of over 4.24\% in the Kolmogorov-Smirnov metric.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeRisk: An Effective Deep Learning Framework for Credit Risk Prediction over Real-World Financial Data

Yi Hu, Hui Li, Yi Wu et al.

Analysis of Financial Risk Behavior Prediction Using Deep Learning and Big Data Algorithms

Zhaoyang Zhang, Haowei Yang, Ao Xiang et al.

An Integrated Machine Learning and Deep Learning Framework for Credit Card Approval Prediction

Yijing Wei, Yanxin Shen, Yujian Long et al.

No citations found for this paper.

Comments (0)