Authors

Summary

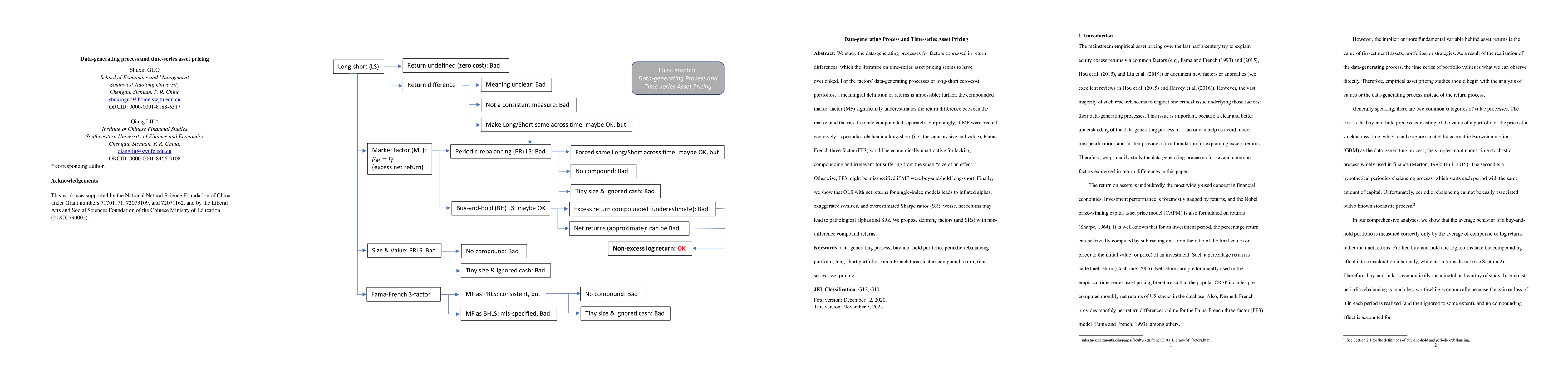

We study the data-generating processes for factors expressed in return differences, which the literature on time-series asset pricing seems to have overlooked. For the factors' data-generating processes or long-short zero-cost portfolios, a meaningful definition of returns is impossible; further, the compounded market factor (MF) significantly underestimates the return difference between the market and the risk-free rate compounded separately. Surprisingly, if MF were treated coercively as periodic-rebalancing long-short (i.e., the same as size and value), Fama-French three-factor (FF3) would be economically unattractive for lacking compounding and irrelevant for suffering from the small "size of an effect." Otherwise, FF3 might be misspecified if MF were buy-and-hold long-short. Finally, we show that OLS with net returns for single-index models leads to inflated alphas, exaggerated t-values, and overestimated Sharpe ratios (SR); worse, net returns may lead to pathological alphas and SRs. We propose defining factors (and SRs) with non-difference compound returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)