Shuxin Guo

4 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Risk-neutral valuation of options under arithmetic Brownian motions

On April 22, 2020, the CME Group switched to Bachelier pricing for a group of oil futures options. The Bachelier model, or more generally the arithmetic Brownian motion (ABM), is not so widely used ...

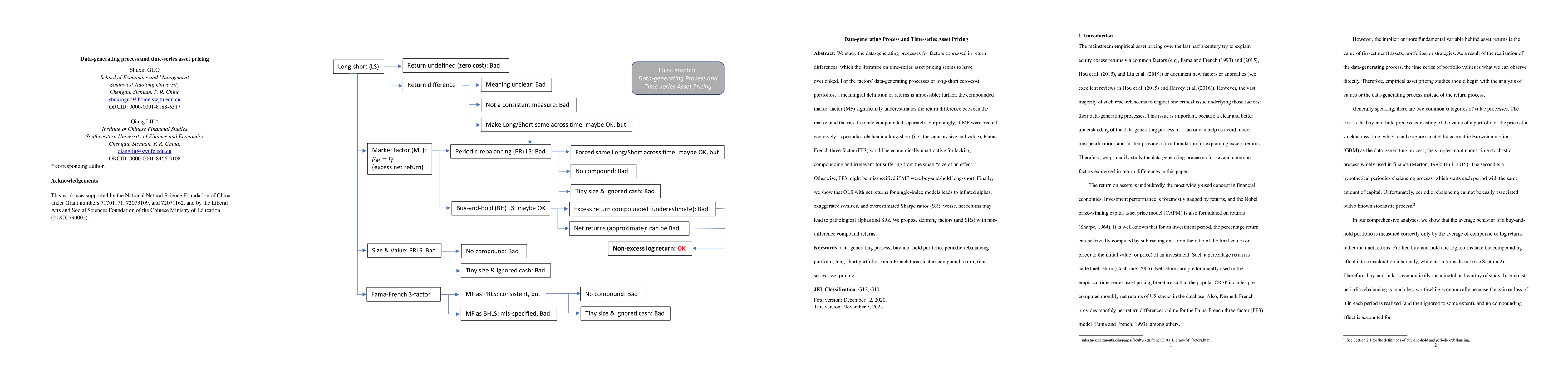

Data-generating process and time-series asset pricing

We study the data-generating processes for factors expressed in return differences, which the literature on time-series asset pricing seems to have overlooked. For the factors' data-generating proce...

Is the annualized compounded return of Medallion over 35%?

It is a challenge to estimate fund performance by compounded returns. Arguably, it is incorrect to use yearly returns directly for compounding, with reported annualized return of above 60% for Medal...

The Black-Scholes-Merton dual equation

We derive the Black-Scholes-Merton dual equation, which has exactly the same form as the Black-Scholes-Merton equation. The novel and general equation works for options with a payoff of homogeneous ...