Authors

Summary

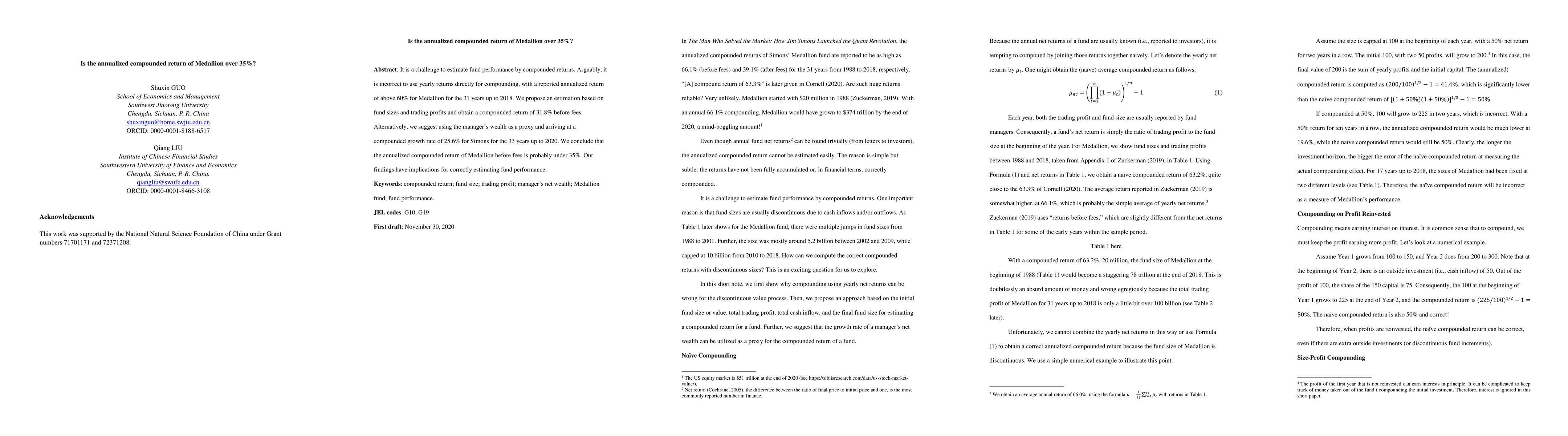

It is a challenge to estimate fund performance by compounded returns. Arguably, it is incorrect to use yearly returns directly for compounding, with reported annualized return of above 60% for Medallion for the 31 years up to 2018. We propose an estimation based on fund sizes and trading profits and obtain a compounded return of 32.6% before fees with a 3% financing rate. Alternatively, we suggest using the manager's wealth as a proxy and arriving at a compounded growth rate of 25.6% for Simons for the 33 years up to 2020. We conclude that the annualized compounded return of Medallion before fees is probably under 35%. Our findings have implications for how to compute fund performance correctly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersThe saddlepoint approximation factors over sample paths of recursively compounded processes

Jesse Goodman

Over-the-counter and compounded mouthwashes for radiotherapy-induced xerostomia: a randomized controlled trial.

Savo, Isabella Silveira, Oliveira, Samanta Vicente de, Melo, Gabriela Banacu de et al.

No citations found for this paper.

Comments (0)