Summary

With the advancement in technology, telematics data which capture vehicle movements information are becoming available to more insurers. As these data capture the actual driving behaviour, they are expected to improve our understanding of driving risk and facilitate more accurate auto-insurance ratemaking. In this paper, we analyze an auto-insurance dataset with telematics data collected from a major European insurer. Through a detailed discussion of the telematics data structure and related data quality issues, we elaborate on practical challenges in processing and incorporating telematics information in loss modelling and ratemaking. Then, with an exploratory data analysis, we demonstrate the existence of heterogeneity in individual driving behaviour, even within the groups of policyholders with and without claims, which supports the study of telematics data. Our regression analysis reiterates the importance of telematics data in claims modelling; in particular, we propose a speed transition matrix that describes discretely recorded speed time series and produces statistically significant predictors for claim counts. We conclude that large speed transitions, together with higher maximum speed attained, nighttime driving and increased harsh braking, are associated with increased claim counts. Moreover, we empirically illustrate the learning effects in driving behaviour: we show that both severe harsh events detected at a high threshold and expected claim counts are not directly proportional with driving time or distance, but they increase at a decreasing rate.

AI Key Findings

Generated Sep 02, 2025

Methodology

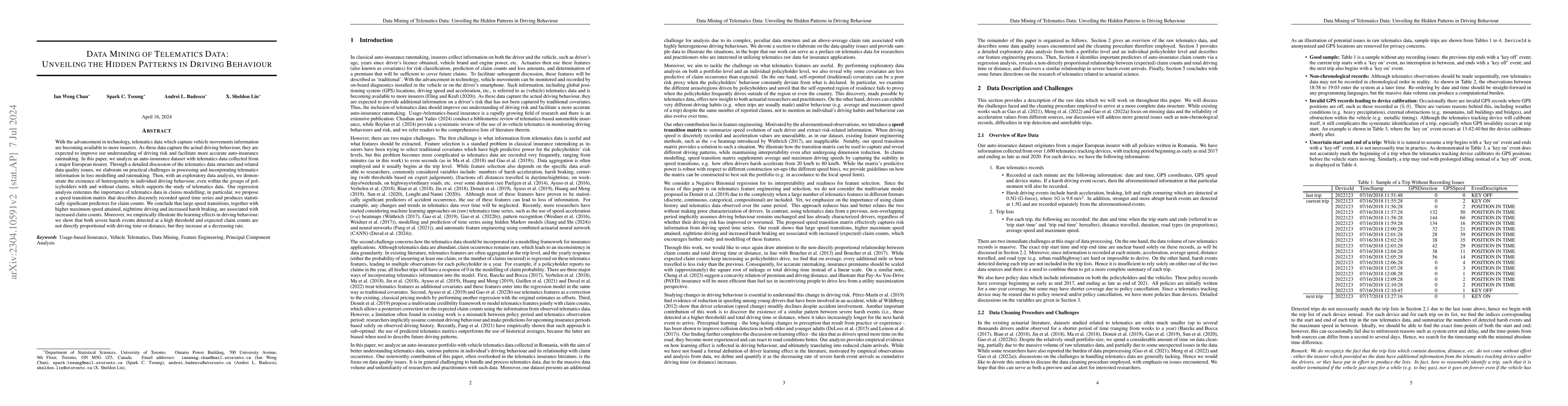

The research analyzes an auto-insurance dataset with telematics data from a major European insurer, exploring data structure, quality issues, and challenges in processing telematics information for loss modeling and ratemaking.

Key Results

- Telematics data shows heterogeneity in individual driving behavior, even within policyholder groups with and without claims.

- Regression analysis highlights the importance of telematics data in claims modeling, proposing a speed transition matrix as a significant predictor for claim counts.

- Large speed transitions, higher maximum speeds, nighttime driving, and increased harsh braking are associated with increased claim counts.

- Learning effects in driving behavior are empirically illustrated, showing that severe harsh events and expected claim counts increase at a decreasing rate with cumulative driving time or distance.

- Traditional summary statistics like average and maximum speed have reduced predictive power, suggesting the need for more flexible feature engineering for telematics data.

Significance

This research improves understanding of driving risk and facilitates more accurate auto-insurance ratemaking by leveraging telematics data to capture actual driving behavior.

Technical Contribution

The paper proposes a speed transition matrix that describes discretely recorded speed time series, significantly improving claim prediction accuracy.

Novelty

The research introduces a novel approach to incorporating telematics data in auto-insurance ratemaking by focusing on individual driving behavior patterns and learning effects.

Limitations

- The study does not account for policyholders' prior driving experience due to the lack of panel data.

- The dataset mainly consists of new drivers with newly installed telematics tracking devices, which may influence their behavior.

- The findings may not generalize to regions with different claim experiences, road conditions, and safety levels.

Future Work

- Investigate the validity of learning effects in longitudinal models with panel data.

- Explore the impact of telematics data on risk assessment in diverse geographical regions and demographics.

- Develop more sophisticated feature engineering techniques to capture a wider range of driving patterns and behaviors.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnsupervised Detection of Anomalous Driving Patterns Using High Resolution Telematics Time Series Data

Andrei L. Badescu, X. Sheldon Lin, Ian Weng Chan

Can Telematics Improve Driving Style? The Use of Behavioural Data in Motor Insurance

Elena Morotti, Alberto Cevolini, Elena Esposito et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)