Summary

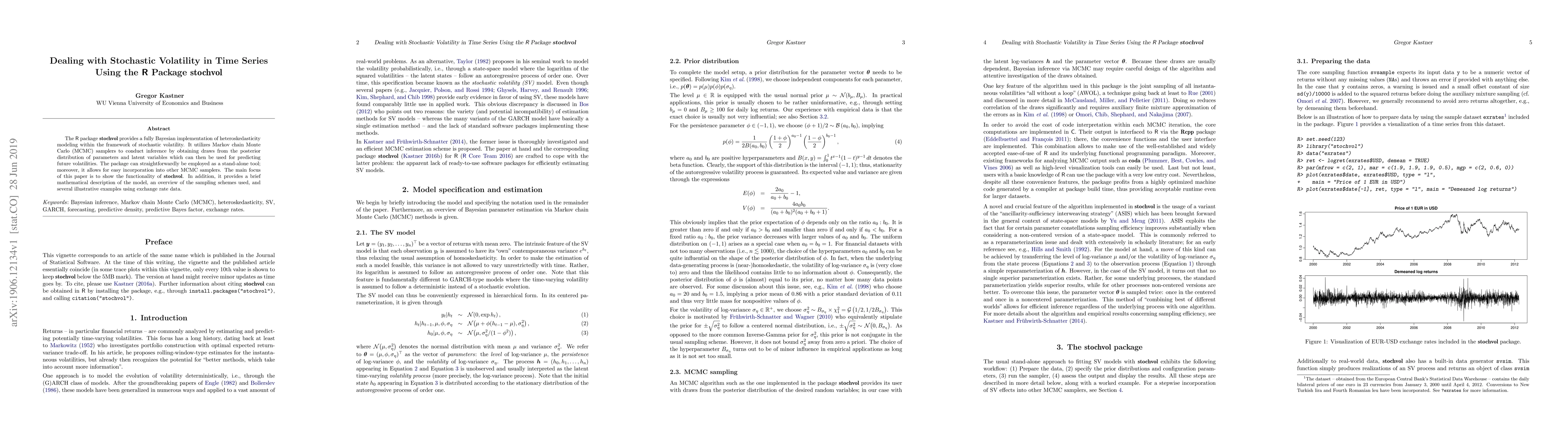

The R package stochvol provides a fully Bayesian implementation of heteroskedasticity modeling within the framework of stochastic volatility. It utilizes Markov chain Monte Carlo (MCMC) samplers to conduct inference by obtaining draws from the posterior distribution of parameters and latent variables which can then be used for predicting future volatilities. The package can straightforwardly be employed as a stand-alone tool; moreover, it allows for easy incorporation into other MCMC samplers. The main focus of this paper is to show the functionality of stochvol. In addition, it provides a brief mathematical description of the model, an overview of the sampling schemes used, and several illustrative examples using exchange rate data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalyzing categorical time series with the R package ctsfeatures

José Antonio Vilar Fernández, Ángel López Oriona

Feature-Based Time-Series Analysis in R using the theft Package

Ben D. Fulcher, Trent Henderson

| Title | Authors | Year | Actions |

|---|

Comments (0)