Authors

Summary

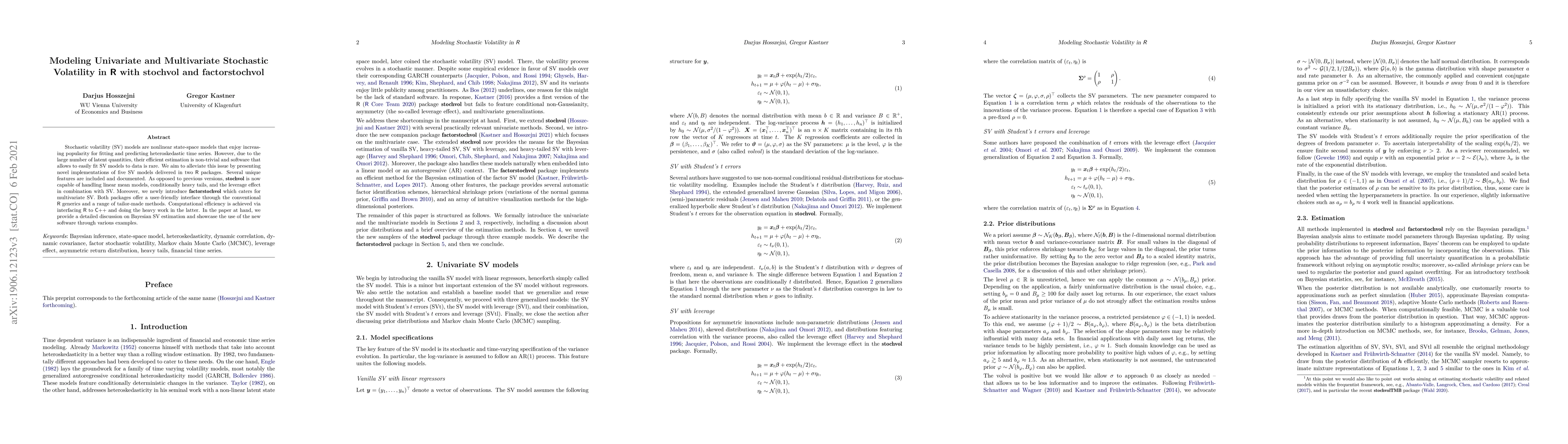

Stochastic volatility (SV) models are nonlinear state-space models that enjoy increasing popularity for fitting and predicting heteroskedastic time series. However, due to the large number of latent quantities, their efficient estimation is non-trivial and software that allows to easily fit SV models to data is rare. We aim to alleviate this issue by presenting novel implementations of four SV models delivered in two R packages. Several unique features are included and documented. As opposed to previous versions, stochvol is now capable of handling linear mean models, heavy-tailed SV, and SV with leverage. Moreover, we newly introduce factorstochvol which caters for multivariate SV. Both packages offer a user-friendly interface through the conventional R generics and a range of tailor-made methods. Computational efficiency is achieved via interfacing R to C++ and doing the heavy work in the latter. In the paper at hand, we provide a detailed discussion on Bayesian SV estimation and showcase the use of the new software through various examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)