Summary

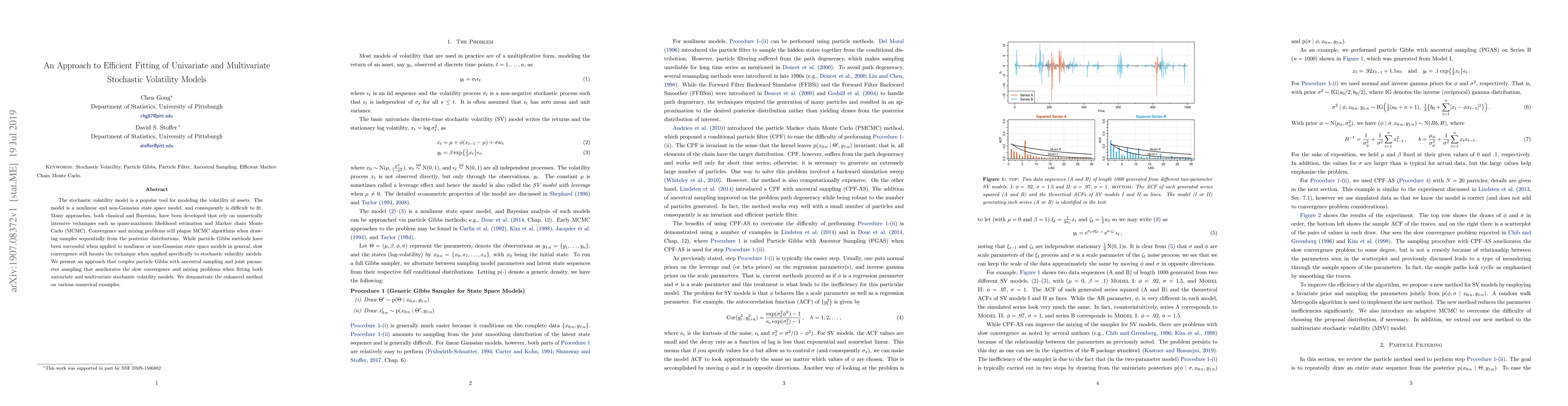

The stochastic volatility model is a popular tool for modeling the volatility of assets. The model is a nonlinear and non-Gaussian state space model, and consequently is difficult to fit. Many approaches, both classical and Bayesian, have been developed that rely on numerically intensive techniques such as quasi-maximum likelihood estimation and Markov chain Monte Carlo (MCMC). Convergence and mixing problems still plague MCMC algorithms when drawing samples sequentially from the posterior distributions. While particle Gibbs methods have been successful when applied to nonlinear or non-Gaussian state space models in general, slow convergence still haunts the technique when applied specifically to stochastic volatility models. We present an approach that couples particle Gibbs with ancestral sampling and joint parameter sampling that ameliorates the slow convergence and mixing problems when fitting both univariate and multivariate stochastic volatility models. We demonstrate the enhanced method on various numerical examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)