Authors

Summary

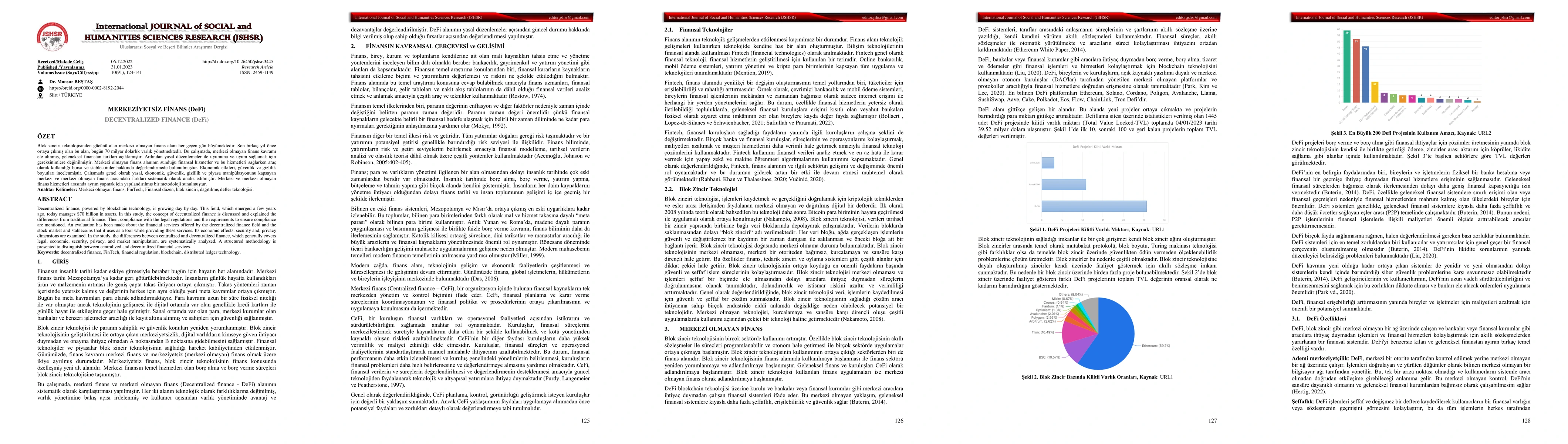

Decentralized finance, powered by blockchain technology, is growing day by day. This field, which emerged a few years ago, today manages $70 billion in assets. In this study, the concept of decentralized finance is discussed and explained the differences from traditional finance. Then, compliance with the legal regulations and the requirements to ensure compliance are mentioned. An evaluation has been made about the financial services offered by the decentralized finance field and the stock market and stablecoins that it uses as a tool while providing these services. Its economic effects, security and, privacy dimensions are examined. In the study, the differences between centralized and decentralized finance, which generally covers legal, economic, security, privacy, and market manipulation, are systematically analyzed. A structured methodology is presented to distinguish between centralized and decentralized financial services. Keywords: decentralized finance, FinTech, financial regulation, blockchain, distributed ledger technology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Decentralized Finance (DeFi)

William J. Knottenbelt, Ariah Klages-Mundt, Lewis Gudgeon et al.

Decentralized Finance (DeFi): A Survey

Xinyu Li, Jian Weng, Chenyang Wang et al.

Disentangling Decentralized Finance (DeFi) Compositions

Stefan Kitzler, Pietro Saggese, Bernhard Haslhofer et al.

SoK: Decentralized Finance (DeFi) Attacks

Dawn Song, Ye Wang, Roger Wattenhofer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)