Summary

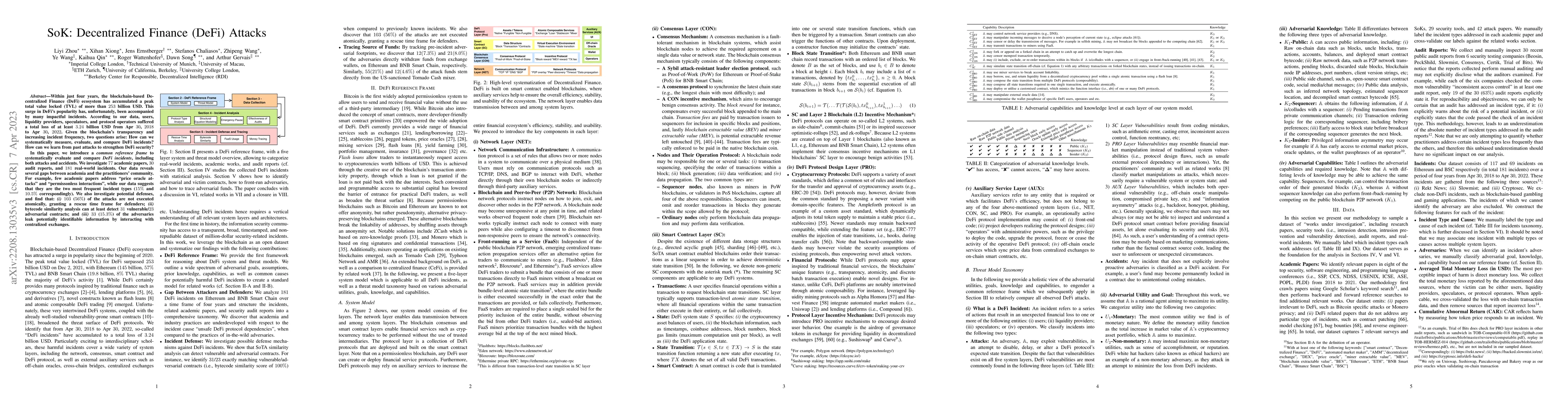

Within just four years, the blockchain-based Decentralized Finance (DeFi) ecosystem has accumulated a peak total value locked (TVL) of more than 253 billion USD. This surge in DeFi's popularity has, unfortunately, been accompanied by many impactful incidents. According to our data, users, liquidity providers, speculators, and protocol operators suffered a total loss of at least 3.24 billion USD from Apr 30, 2018 to Apr 30, 2022. Given the blockchain's transparency and increasing incident frequency, two questions arise: How can we systematically measure, evaluate, and compare DeFi incidents? How can we learn from past attacks to strengthen DeFi security? In this paper, we introduce a common reference frame to systematically evaluate and compare DeFi incidents, including both attacks and accidents. We investigate 77 academic papers, 30 audit reports, and 181 real-world incidents. Our data reveals several gaps between academia and the practitioners' community. For example, few academic papers address "price oracle attacks" and "permissonless interactions", while our data suggests that they are the two most frequent incident types (15% and 10.5% correspondingly). We also investigate potential defenses, and find that: (i) 103 (56%) of the attacks are not executed atomically, granting a rescue time frame for defenders; (ii) SoTA bytecode similarity analysis can at least detect 31 vulnerable/23 adversarial contracts; and (iii) 33 (15.3%) of the adversaries leak potentially identifiable information by interacting with centralized exchanges.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Decentralized Finance (DeFi)

William J. Knottenbelt, Ariah Klages-Mundt, Lewis Gudgeon et al.

SoK: Decentralized Finance (DeFi) -- Fundamentals, Taxonomy and Risks

Burkhard Stiller, Krzysztof Gogol, Claudio Tessone et al.

Decentralized Finance (DeFi): A Survey

Xinyu Li, Jian Weng, Chenyang Wang et al.

Disentangling Decentralized Finance (DeFi) Compositions

Stefan Kitzler, Pietro Saggese, Bernhard Haslhofer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)