Summary

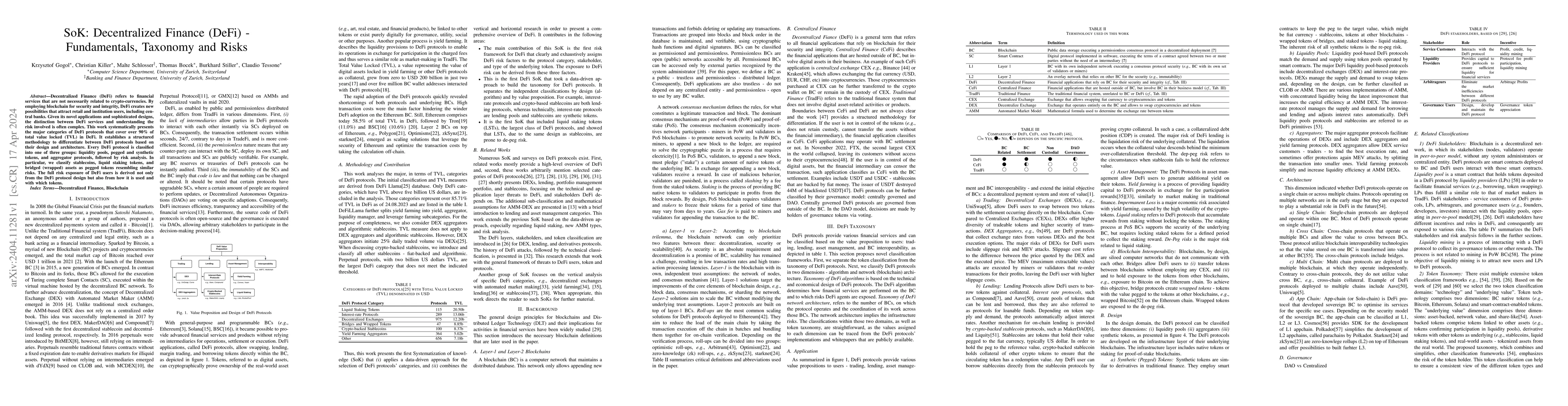

Decentralized Finance (DeFi) refers to financial services that are not necessarily related to crypto-currencies. By employing blockchain for security and integrity, DeFi creates new possibilities that attract retail and institution users, including central banks. Given its novel applications and sophisticated designs, the distinction between DeFi services and understanding the risk involved is often complex. This work systematically presents the major categories of DeFi protocols that cover over 90\% of total value locked (TVL) in DeFi. It establishes a structured methodology to differentiate between DeFi protocols based on their design and architecture. Every DeFi protocol is classified into one of three groups: liquidity pools, pegged and synthetic tokens, and aggregator protocols, followed by risk analysis. In particular, we classify stablecoins, liquid staking tokens, and bridged (wrapped) assets as pegged tokens resembling similar risks. The full risk exposure of DeFi users is derived not only from the DeFi protocol design but also from how it is used and with which tokens.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Decentralized Finance (DeFi)

William J. Knottenbelt, Ariah Klages-Mundt, Lewis Gudgeon et al.

SoK: Decentralized Finance (DeFi) Attacks

Dawn Song, Ye Wang, Roger Wattenhofer et al.

Decentralized Finance (DeFi): A Survey

Xinyu Li, Jian Weng, Chenyang Wang et al.

Disentangling Decentralized Finance (DeFi) Compositions

Stefan Kitzler, Pietro Saggese, Bernhard Haslhofer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)