Authors

Summary

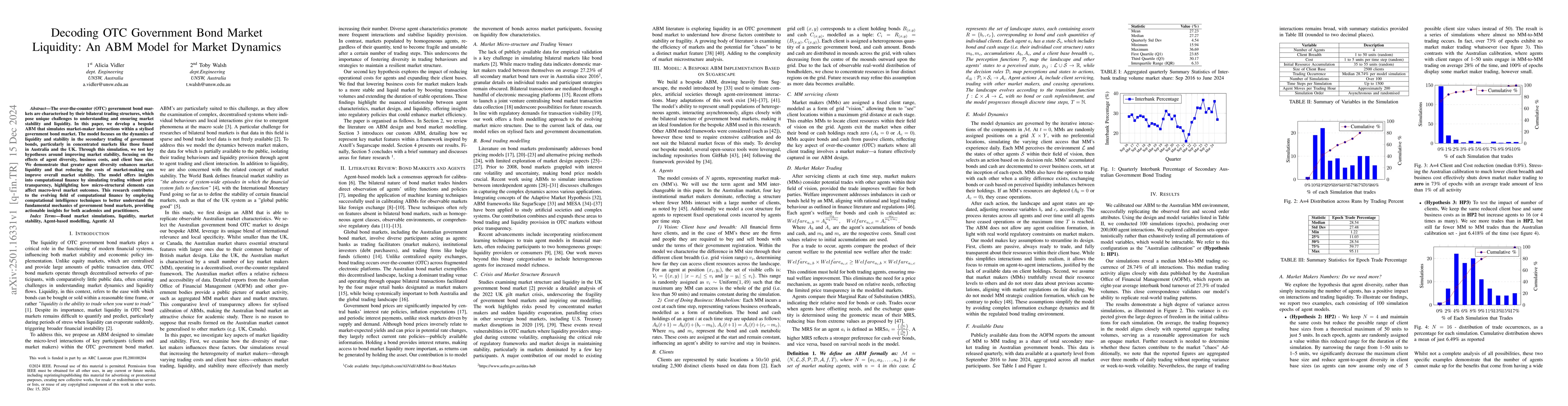

The over-the-counter (OTC) government bond markets are characterised by their bilateral trading structures, which pose unique challenges to understanding and ensuring market stability and liquidity. In this paper, we develop a bespoke ABM that simulates market-maker interactions within a stylised government bond market. The model focuses on the dynamics of liquidity and stability in the secondary trading of government bonds, particularly in concentrated markets like those found in Australia and the UK. Through this simulation, we test key hypotheses around improving market stability, focusing on the effects of agent diversity, business costs, and client base size. We demonstrate that greater agent diversity enhances market liquidity and that reducing the costs of market-making can improve overall market stability. The model offers insights into computational finance by simulating trading without price transparency, highlighting how micro-structural elements can affect macro-level market outcomes. This research contributes to the evolving field of computational finance by employing computational intelligence techniques to better understand the fundamental mechanics of government bond markets, providing actionable insights for both academics and practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNon cooperative Liquidity Games and their application to bond market trading

Toby Walsh, Alicia Vidler

Size matters for OTC market makers: general results and dimensionality reduction techniques

Philippe Bergault, Olivier Guéant

| Title | Authors | Year | Actions |

|---|

Comments (0)