Authors

Summary

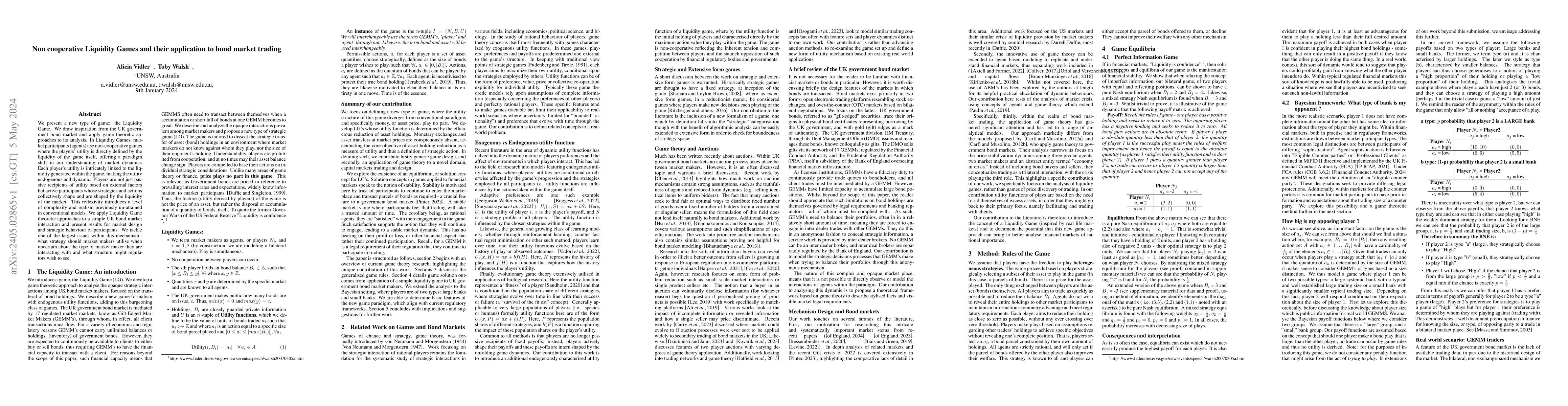

We present a new type of game, the Liquidity Game. We draw inspiration from the UK government bond market and apply game theoretic approaches to its analysis. In Liquidity Games, market participants (agents) use non-cooperative games where the players' utility is directly defined by the liquidity of the game itself, offering a paradigm shift in our understanding of market dynamics. Each player's utility is intricately linked to the liquidity generated within the game, making the utility endogenous and dynamic. Players are not just passive recipients of utility based on external factors but active participants whose strategies and actions collectively shape and are shaped by the liquidity of the market. This reflexivity introduces a level of complexity and realism previously unattainable in conventional models. We apply Liquidity Game theoretic approaches to a simple UK bond market interaction and present results for market design and strategic behavior of participants. We tackle one of the largest issues within this mechanism, namely what strategy should market makers utilize when uncertain about the type of market maker they are interacting with, and what structure might regulators wish to see.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)