Summary

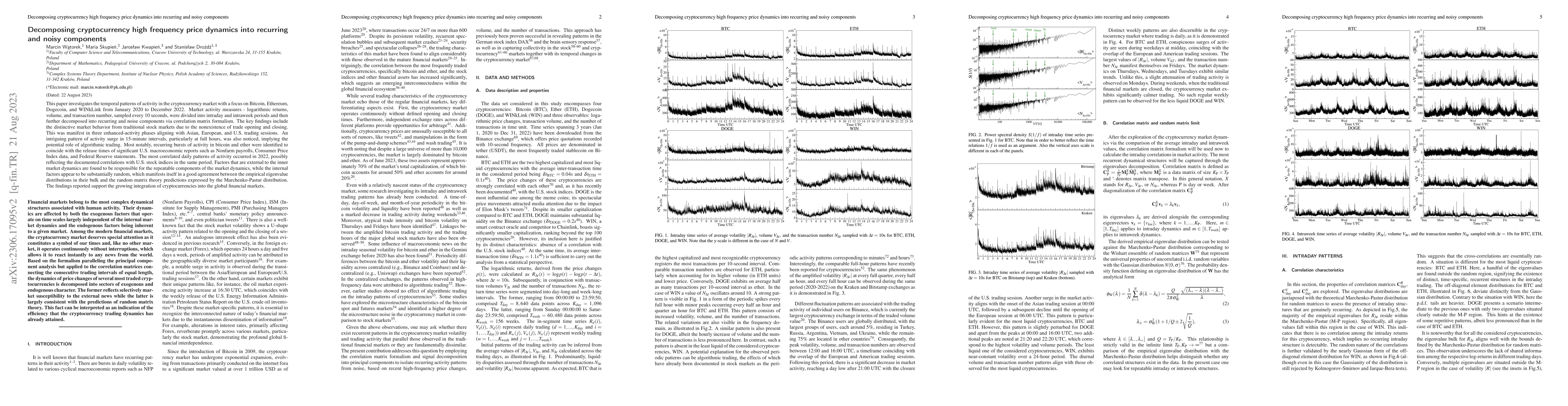

This paper investigates the temporal patterns of activity in the cryptocurrency market with a focus on Bitcoin, Ethereum, Dogecoin, and WINkLink from January 2020 to December 2022. Market activity measures - logarithmic returns, volume, and transaction number, sampled every 10 seconds, were divided into intraday and intraweek periods and then further decomposed into recurring and noise components via correlation matrix formalism. The key findings include the distinctive market behavior from traditional stock markets due to the nonexistence of trade opening and closing. This was manifest in three enhanced-activity phases aligning with Asian, European, and U.S. trading sessions. An intriguing pattern of activity surge in 15-minute intervals, particularly at full hours, was also noticed, implying the potential role of algorithmic trading. Most notably, recurring bursts of activity in bitcoin and ether were identified to coincide with the release times of significant U.S. macroeconomic reports such as Nonfarm payrolls, Consumer Price Index data, and Federal Reserve statements. The most correlated daily patterns of activity occurred in 2022, possibly reflecting the documented correlations with U.S. stock indices in the same period. Factors that are external to the inner market dynamics are found to be responsible for the repeatable components of the market dynamics, while the internal factors appear to be substantially random, which manifests itself in a good agreement between the empirical eigenvalue distributions in their bulk and the random matrix theory predictions expressed by the Marchenko-Pastur distribution. The findings reported support the growing integration of cryptocurrencies into the global financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)