Summary

We analyze the potential of reinsurance for reversing the current trend of decreasing capital guarantees in life insurance products. Providing an insurer with an opportunity to shift part of the financial risk to a reinsurer, we solve the insurer's dynamic investment-reinsurance optimization problem under simultaneous Value-at-Risk and no-short-selling constraints. We introduce the concept of guarantee-equivalent utility gain and use it to compare life insurance products with and without reinsurance. Our numerical studies indicate that the optimally managed reinsurance allows the insurer to offer significantly higher capital guarantees to clients without any loss in the insurer's expected utility. The longer the investment horizon and the less risk-averse the insurer, the more prominent the reinsurance benefit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

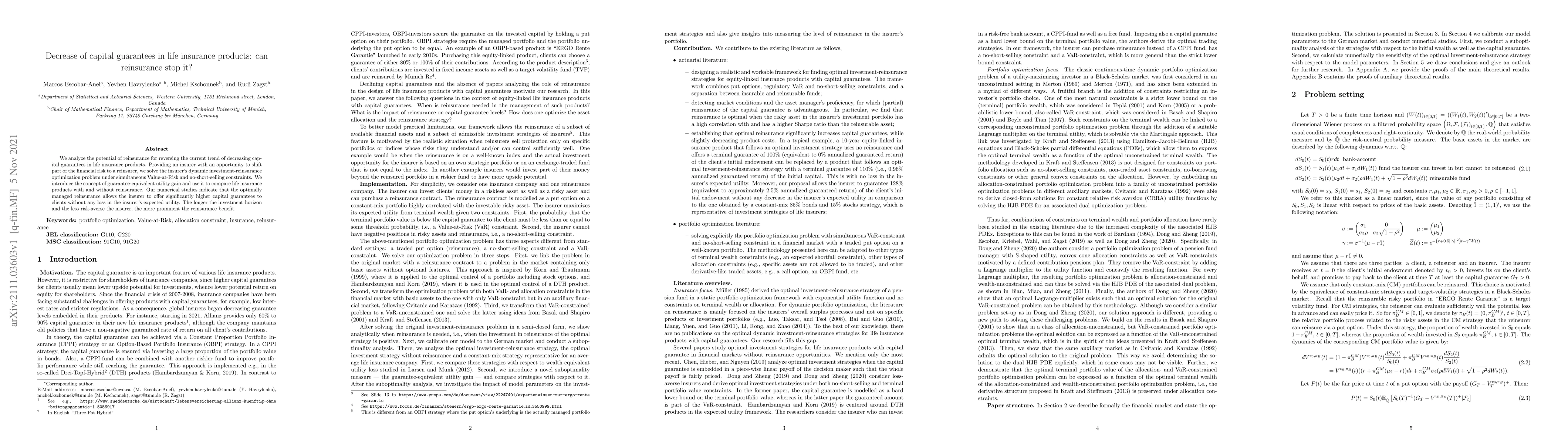

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)