Summary

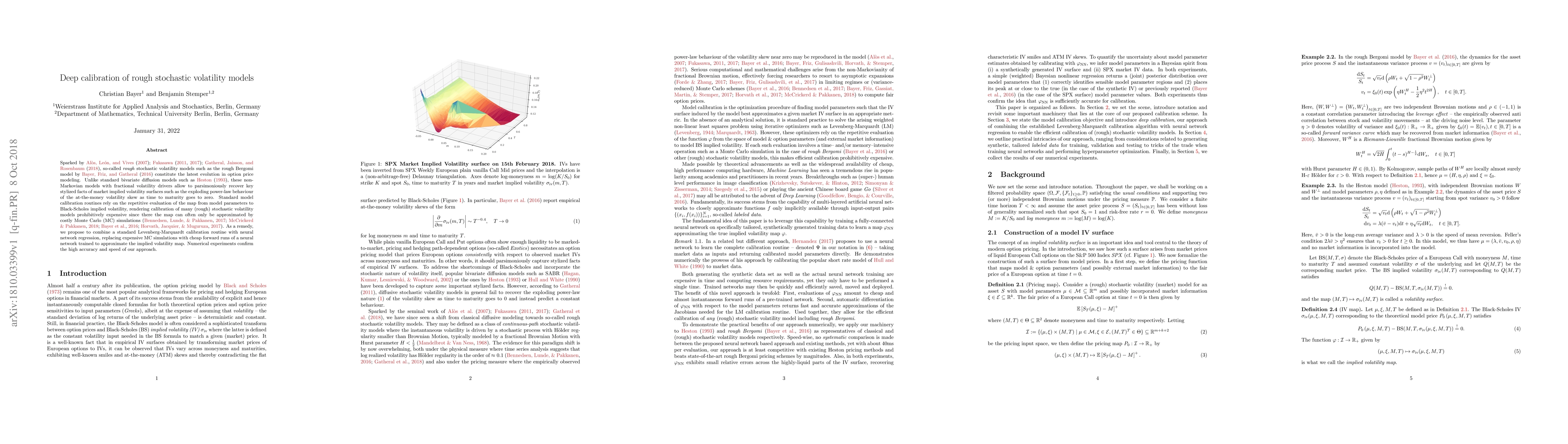

Sparked by Al\`os, Le\'on, and Vives (2007); Fukasawa (2011, 2017); Gatheral, Jaisson, and Rosenbaum (2018), so-called rough stochastic volatility models such as the rough Bergomi model by Bayer, Friz, and Gatheral (2016) constitute the latest evolution in option price modeling. Unlike standard bivariate diffusion models such as Heston (1993), these non-Markovian models with fractional volatility drivers allow to parsimoniously recover key stylized facts of market implied volatility surfaces such as the exploding power-law behaviour of the at-the-money volatility skew as time to maturity goes to zero. Standard model calibration routines rely on the repetitive evaluation of the map from model parameters to Black-Scholes implied volatility, rendering calibration of many (rough) stochastic volatility models prohibitively expensive since there the map can often only be approximated by costly Monte Carlo (MC) simulations (Bennedsen, Lunde, & Pakkanen, 2017; McCrickerd & Pakkanen, 2018; Bayer et al., 2016; Horvath, Jacquier, & Muguruza, 2017). As a remedy, we propose to combine a standard Levenberg-Marquardt calibration routine with neural network regression, replacing expensive MC simulations with cheap forward runs of a neural network trained to approximate the implied volatility map. Numerical experiments confirm the high accuracy and speed of our approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproximation Rates for Deep Calibration of (Rough) Stochastic Volatility Models

Lukas Gonon, Francesca Biagini, Niklas Walter

| Title | Authors | Year | Actions |

|---|

Comments (0)