Summary

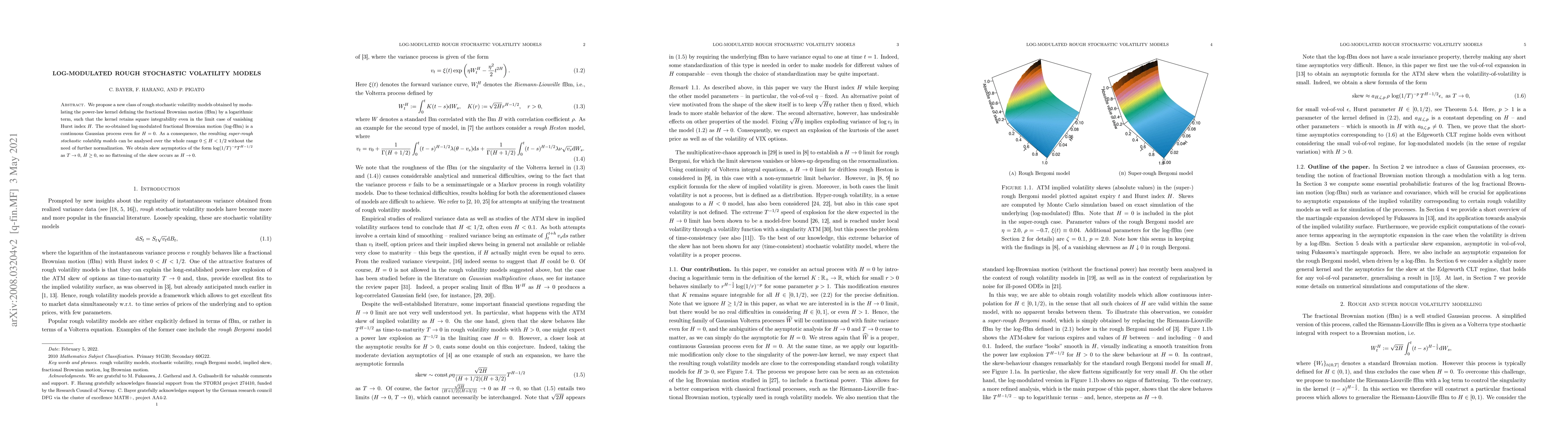

We propose a new class of rough stochastic volatility models obtained by modulating the power-law kernel defining the fractional Brownian motion (fBm) by a logarithmic term, such that the kernel retains square integrability even in the limit case of vanishing Hurst index $H$. The so-obtained log-modulated fractional Brownian motion (log-fBm) is a continuous Gaussian process even for $H = 0$. As a consequence, the resulting super-rough stochastic volatility models can be analysed over the whole range $0 \le H < 1/2$ without the need of further normalization. We obtain skew asymptotics of the form $\log(1/T)^{-p} T^{H-1/2}$ as $T\to 0$, $H \ge 0$, so no flattening of the skew occurs as $H \to 0$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRough PDEs for local stochastic volatility models

Peter K. Friz, Christian Bayer, Luca Pelizzari et al.

On simulation of rough Volterra stochastic volatility models

Jan Pospíšil, Jan Matas

| Title | Authors | Year | Actions |

|---|

Comments (0)