Summary

A new method for stochastic control based on neural networks and using randomisation of discrete random variables is proposed and applied to optimal stopping time problems. The method models directly the policy and does not need the derivation of a dynamic programming principle nor a backward stochastic differential equation. Unlike continuous optimization where automatic differentiation is used directly, we propose a likelihood ratio method for gradient computation. Numerical tests are done on the pricing of American and swing options. The proposed algorithm succeeds in pricing high dimensional American and swing options in a reasonable computation time, which is not possible with classical algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

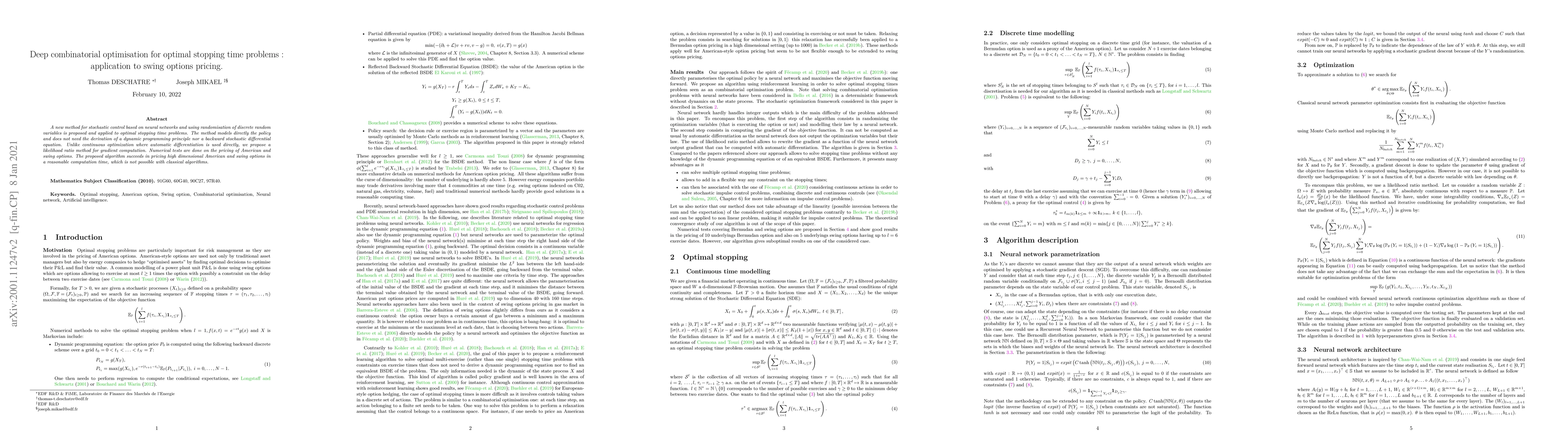

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)