Summary

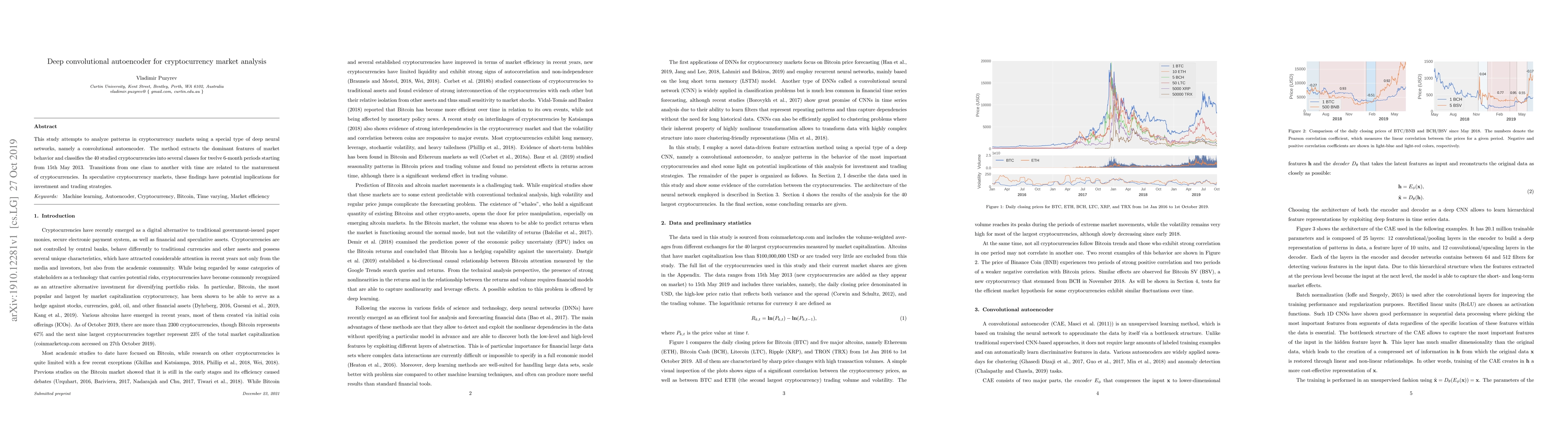

This study attempts to analyze patterns in cryptocurrency markets using a special type of deep neural networks, namely a convolutional autoencoder. The method extracts the dominant features of market behavior and classifies the 40 studied cryptocurrencies into several classes for twelve 6-month periods starting from 15th May 2013. Transitions from one class to another with time are related to the maturement of cryptocurrencies. In speculative cryptocurrency markets, these findings have potential implications for investment and trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSocial Media Sentiment Analysis for Cryptocurrency Market Prediction

Anton Kolonin, Mukul Vishwas, Ali Raheman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)