Summary

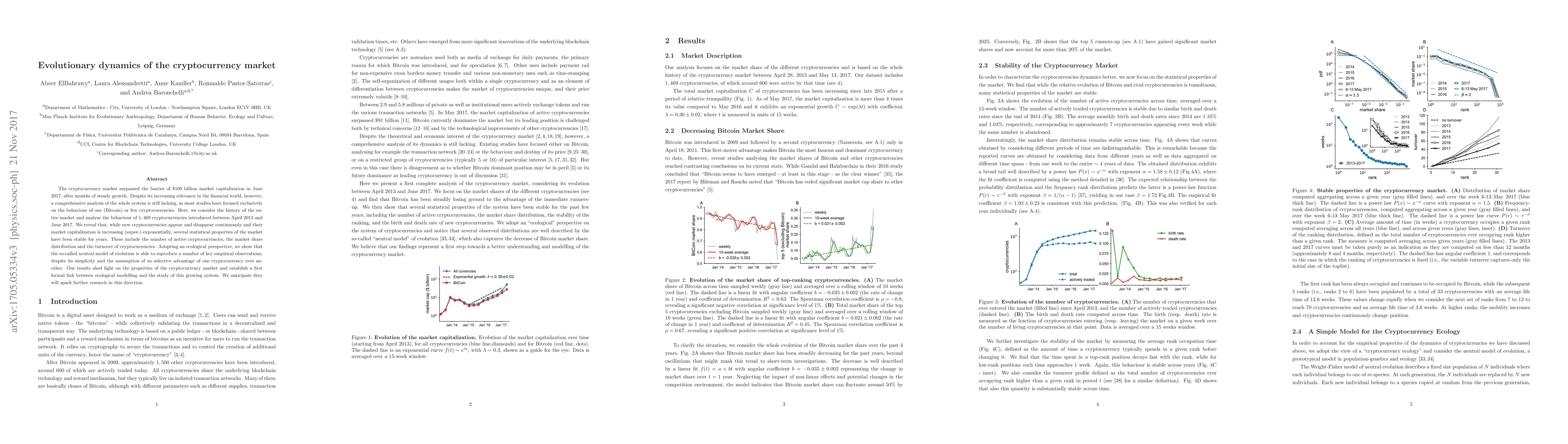

The cryptocurrency market surpassed the barrier of \$100 billion market capitalization in June 2017, after months of steady growth. Despite its increasing relevance in the financial world, however, a comprehensive analysis of the whole system is still lacking, as most studies have focused exclusively on the behaviour of one (Bitcoin) or few cryptocurrencies. Here, we consider the history of the entire market and analyse the behaviour of 1,469 cryptocurrencies introduced between April 2013 and June 2017. We reveal that, while new cryptocurrencies appear and disappear continuously and their market capitalization is increasing (super-)exponentially, several statistical properties of the market have been stable for years. These include the number of active cryptocurrencies, the market share distribution and the turnover of cryptocurrencies. Adopting an ecological perspective, we show that the so-called neutral model of evolution is able to reproduce a number of key empirical observations, despite its simplicity and the assumption of no selective advantage of one cryptocurrency over another. Our results shed light on the properties of the cryptocurrency market and establish a first formal link between ecological modelling and the study of this growing system. We anticipate they will spark further research in this direction.

AI Key Findings

Generated Sep 03, 2025

Methodology

The study analyzes the entire cryptocurrency market from April 2013 to June 2017, considering 1,469 cryptocurrencies. It applies an ecological perspective and the neutral model of evolution to understand the market's statistical properties, including the number of active cryptocurrencies, market share distribution, and turnover.

Key Results

- The market has shown exponential growth in total market capitalization over the past year.

- Bitcoin's market share has been steadily decreasing.

- Several observable properties, such as the number of active cryptocurrencies, market share distribution, and ranking turnover, have remained stable for years.

- The neutral model of evolution successfully reproduces key empirical observations of the cryptocurrency market, despite its simplicity and the assumption of no selective advantage for any cryptocurrency.

- The model's aggregated species distribution follows a power-law distribution with an exponent of 1.5, consistent with the empirical value obtained from the data.

Significance

This research establishes a formal link between ecological modeling and the study of the growing cryptocurrency market, providing insights into its long-term properties and sparking further research in this direction.

Technical Contribution

The paper introduces an ecological perspective and applies the neutral model of evolution to analyze the cryptocurrency market, successfully reproducing several key empirical observations.

Novelty

This work is novel in its comprehensive analysis of the entire cryptocurrency market, its application of the neutral model of evolution, and its findings on the stability of certain market properties despite continuous introduction and disappearance of cryptocurrencies.

Limitations

- The model does not capture the full complexity of the cryptocurrency ecosystem.

- It assumes no selective advantage for any cryptocurrency, which might not reflect real-world dynamics.

- The analysis does not account for the role of expanding overall market capitalization or detailed transaction information.

Future Work

- Investigate the impact of expanding overall market capitalization on the cryptocurrency market.

- Incorporate information about single transactions in the modeling picture when available.

- Explore the effects of legislative, technical, and social advancements on the cryptocurrency market.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)