Summary

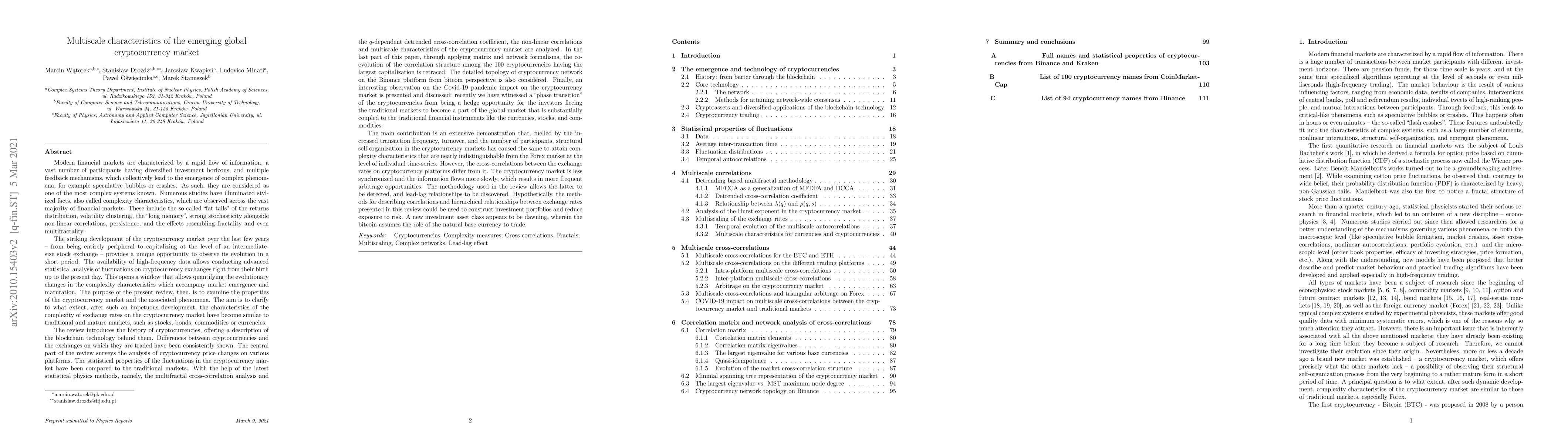

The review introduces the history of cryptocurrencies, offering a description of the blockchain technology behind them. Differences between cryptocurrencies and the exchanges on which they are traded have been shown. The central part surveys the analysis of cryptocurrency price changes on various platforms. The statistical properties of the fluctuations in the cryptocurrency market have been compared to the traditional markets. With the help of the latest statistical physics methods the non-linear correlations and multiscale characteristics of the cryptocurrency market are analyzed. In the last part the co-evolution of the correlation structure among the 100 cryptocurrencies having the largest capitalization is retraced. The detailed topology of cryptocurrency network on the Binance platform from bitcoin perspective is also considered. Finally, an interesting observation on the Covid-19 pandemic impact on the cryptocurrency market is presented and discussed: recently we have witnessed a "phase transition" of the cryptocurrencies from being a hedge opportunity for the investors fleeing the traditional markets to become a part of the global market that is substantially coupled to the traditional financial instruments like the currencies, stocks, and commodities. The main contribution is an extensive demonstration that structural self-organization in the cryptocurrency markets has caused the same to attain complexity characteristics that are nearly indistinguishable from the Forex market at the level of individual time-series. However, the cross-correlations between the exchange rates on cryptocurrency platforms differ from it. The cryptocurrency market is less synchronized and the information flows more slowly, which results in more frequent arbitrage opportunities. The methodology used in the review allows the latter to be detected, and lead-lag relationships to be discovered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhat is mature and what is still emerging in the cryptocurrency market?

Marcin Wątorek, Jarosław Kwapień, Stanisław Drożdż

| Title | Authors | Year | Actions |

|---|

Comments (0)