Summary

This study examines whether the efficiency of cryptocurrency markets (Bitcoin and Ethereum) evolve over time based on Lo's (2004) adaptive market hypothesis (AMH). In particular, we measure the degree of market efficiency using a generalized least squares-based time-varying model that does not depend on sample size, unlike previous studies that used conventional methods. The empirical results show that (1) the degree of market efficiency varies with time in the markets, (2) Bitcoin's market efficiency level is higher than that of Ethereum over most periods, and (3) a market with high market liquidity has been evolving. We conclude that the results support the AMH for the most established cryptocurrency market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

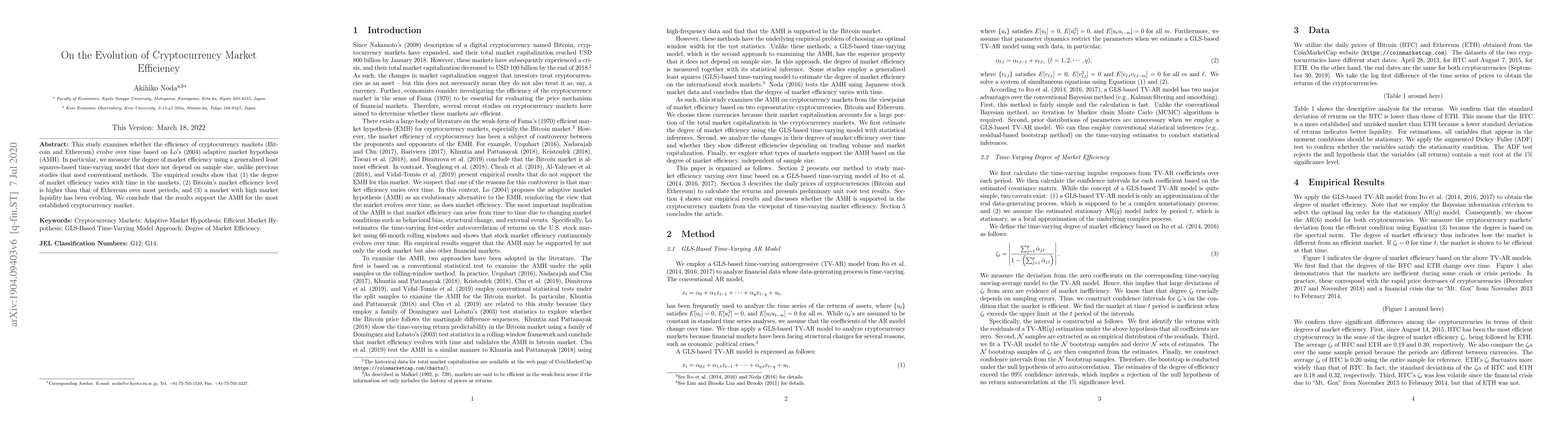

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)