Summary

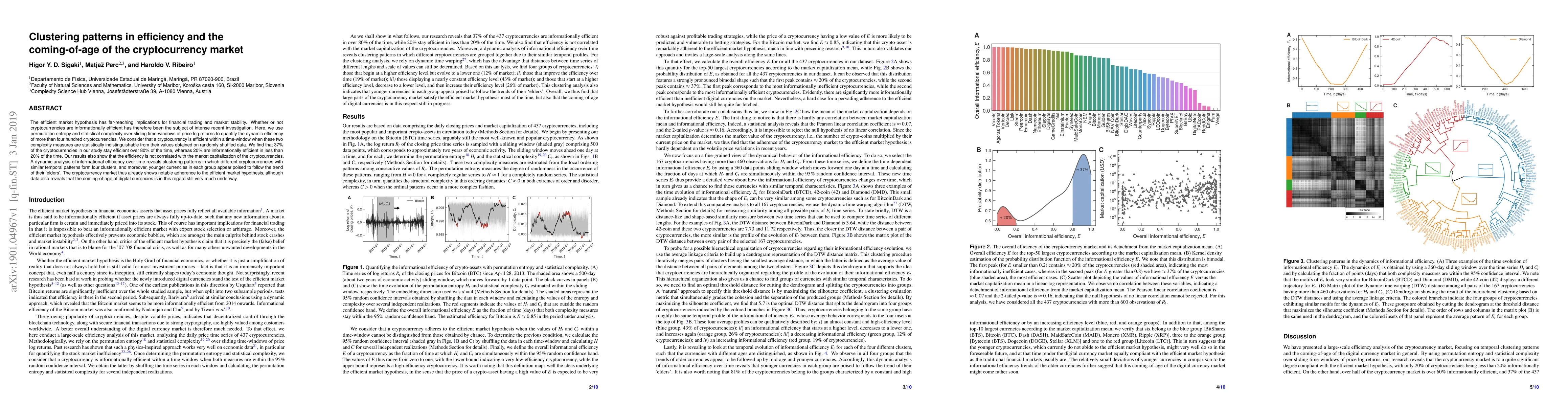

The efficient market hypothesis has far-reaching implications for financial trading and market stability. Whether or not cryptocurrencies are informationally efficient has therefore been the subject of intense recent investigation. Here, we use permutation entropy and statistical complexity over sliding time-windows of price log returns to quantify the dynamic efficiency of more than four hundred cryptocurrencies. We consider that a cryptocurrency is efficient within a time-window when these two complexity measures are statistically indistinguishable from their values obtained on randomly shuffled data. We find that 37% of the cryptocurrencies in our study stay efficient over 80% of the time, whereas 20% are informationally efficient in less than 20% of the time. Our results also show that the efficiency is not correlated with the market capitalization of the cryptocurrencies. A dynamic analysis of informational efficiency over time reveals clustering patterns in which different cryptocurrencies with similar temporal patterns form four clusters, and moreover, younger currencies in each group appear poised to follow the trend of their 'elders'. The cryptocurrency market thus already shows notable adherence to the efficient market hypothesis, although data also reveals that the coming-of-age of digital currencies is in this regard still very much underway.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTesting macroecological theories in cryptocurrency market: neutral models can not describe diversity patterns and their variation

Edgardo Brigatti, Estevan Augusto Amazonas Mendes

| Title | Authors | Year | Actions |

|---|

Comments (0)