Summary

Credit scoring models based on accepted applications may be biased and their consequences can have a statistical and economic impact. Reject inference is the process of attempting to infer the creditworthiness status of the rejected applications. In this research, we use deep generative models to develop two new semi-supervised Bayesian models for reject inference in credit scoring, in which we model the data generating process to be dependent on a Gaussian mixture. The goal is to improve the classification accuracy in credit scoring models by adding reject applications. Our proposed models infer the unknown creditworthiness of the rejected applications by exact enumeration of the two possible outcomes of the loan (default or non-default). The efficient stochastic gradient optimization technique used in deep generative models makes our models suitable for large data sets. Finally, the experiments in this research show that our proposed models perform better than classical and alternative machine learning models for reject inference in credit scoring.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBest Practices for Responsible Machine Learning in Credit Scoring

Vitoria Guardieiro, Giovani Valdrighi, Athyrson M. Ribeiro et al.

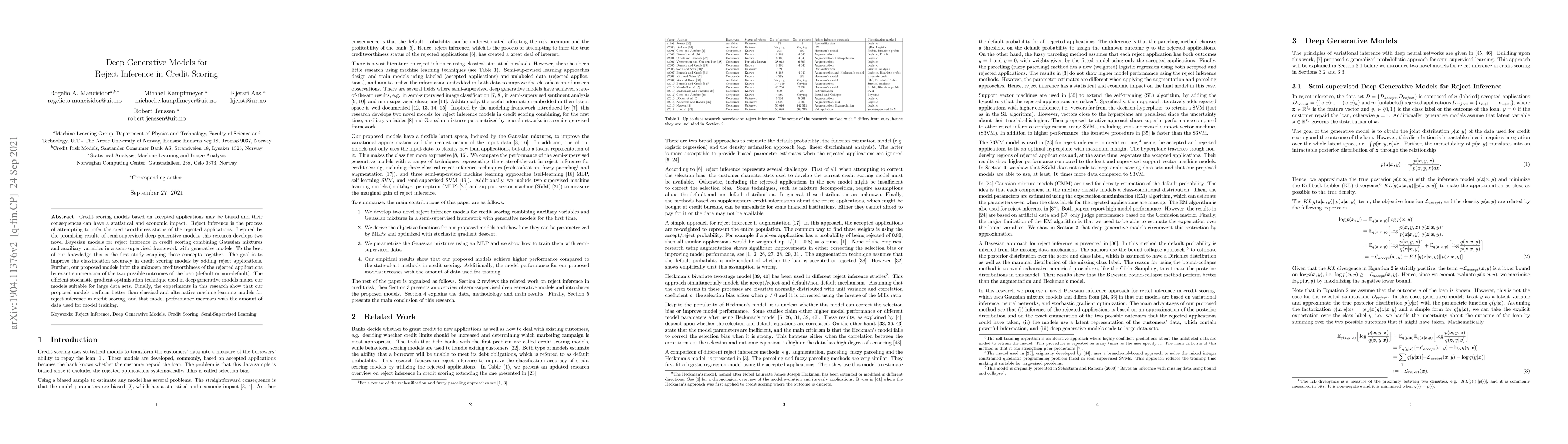

| Title | Authors | Year | Actions |

|---|

Comments (0)