Summary

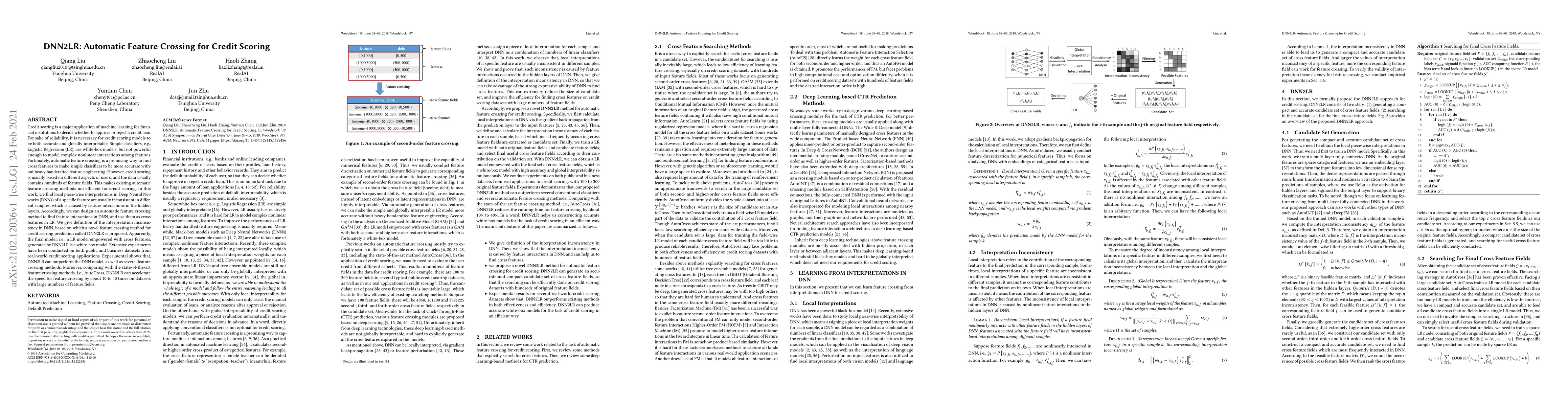

Credit scoring is a major application of machine learning for financial institutions to decide whether to approve or reject a credit loan. For sake of reliability, it is necessary for credit scoring models to be both accurate and globally interpretable. Simple classifiers, e.g., Logistic Regression (LR), are white-box models, but not powerful enough to model complex nonlinear interactions among features. Fortunately, automatic feature crossing is a promising way to find cross features to make simple classifiers to be more accurate without heavy handcrafted feature engineering. However, credit scoring is usually based on different aspects of users, and the data usually contains hundreds of feature fields. This makes existing automatic feature crossing methods not efficient for credit scoring. In this work, we find local piece-wise interpretations in Deep Neural Networks (DNNs) of a specific feature are usually inconsistent in different samples, which is caused by feature interactions in the hidden layers. Accordingly, we can design an automatic feature crossing method to find feature interactions in DNN, and use them as cross features in LR. We give definition of the interpretation inconsistency in DNN, based on which a novel feature crossing method for credit scoring prediction called DNN2LR is proposed. Apparently, the final model, i.e., a LR model empowered with cross features, generated by DNN2LR is a white-box model. Extensive experiments have been conducted on both public and business datasets from real-world credit scoring applications. Experimental shows that, DNN2LR can outperform the DNN model, as well as several feature crossing methods. Moreover, comparing with the state-of-the-art feature crossing methods, i.e., AutoCross, DNN2LR can accelerate the speed for feature crossing by about 10 to 40 times on datasets with large numbers of feature fields.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)