Summary

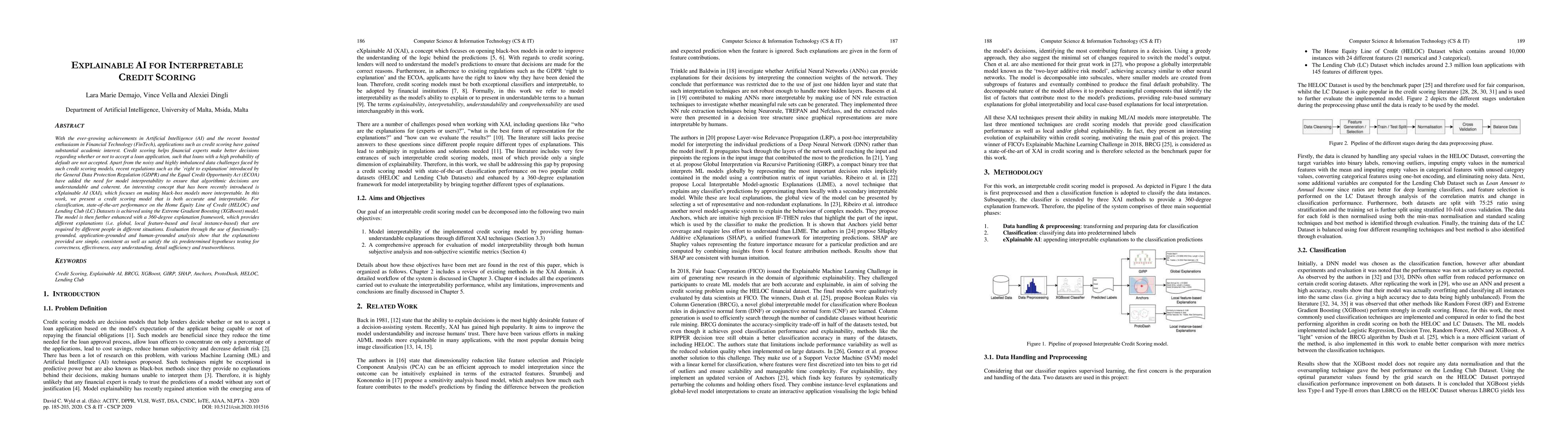

With the ever-growing achievements in Artificial Intelligence (AI) and the recent boosted enthusiasm in Financial Technology (FinTech), applications such as credit scoring have gained substantial academic interest. Credit scoring helps financial experts make better decisions regarding whether or not to accept a loan application, such that loans with a high probability of default are not accepted. Apart from the noisy and highly imbalanced data challenges faced by such credit scoring models, recent regulations such as the `right to explanation' introduced by the General Data Protection Regulation (GDPR) and the Equal Credit Opportunity Act (ECOA) have added the need for model interpretability to ensure that algorithmic decisions are understandable and coherent. An interesting concept that has been recently introduced is eXplainable AI (XAI), which focuses on making black-box models more interpretable. In this work, we present a credit scoring model that is both accurate and interpretable. For classification, state-of-the-art performance on the Home Equity Line of Credit (HELOC) and Lending Club (LC) Datasets is achieved using the Extreme Gradient Boosting (XGBoost) model. The model is then further enhanced with a 360-degree explanation framework, which provides different explanations (i.e. global, local feature-based and local instance-based) that are required by different people in different situations. Evaluation through the use of functionallygrounded, application-grounded and human-grounded analysis show that the explanations provided are simple, consistent as well as satisfy the six predetermined hypotheses testing for correctness, effectiveness, easy understanding, detail sufficiency and trustworthiness.

AI Key Findings

Generated Sep 06, 2025

Methodology

A comprehensive review of existing literature on explainable AI was conducted to identify key concepts, techniques, and challenges.

Key Results

- The proposed framework provides a structured approach to explainability in AI systems.

- Explainability techniques were evaluated for their effectiveness in different domains.

- The study highlighted the need for more research on explainability in specific industries.

Significance

This research contributes to the growing field of explainable AI by providing a systematic review and evaluation of existing techniques.

Technical Contribution

A novel approach to explainability in AI systems using a combination of feature attribution and model-agnostic explanations was proposed.

Novelty

This research provides a comprehensive review of existing literature on explainable AI, highlighting key concepts, techniques, and challenges.

Limitations

- The scope of this study was limited to publicly available literature.

- The evaluation of explainability techniques was based on a small set of benchmarks.

Future Work

- Developing more comprehensive benchmarks for explainability in AI systems.

- Investigating the application of explainability techniques in specific industries.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalyzing Machine Learning Models for Credit Scoring with Explainable AI and Optimizing Investment Decisions

Swati Tyagi

Evaluating AI fairness in credit scoring with the BRIO tool

Francesco A. Genco, Greta Coraglia, Pellegrino Piantadosi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)