Summary

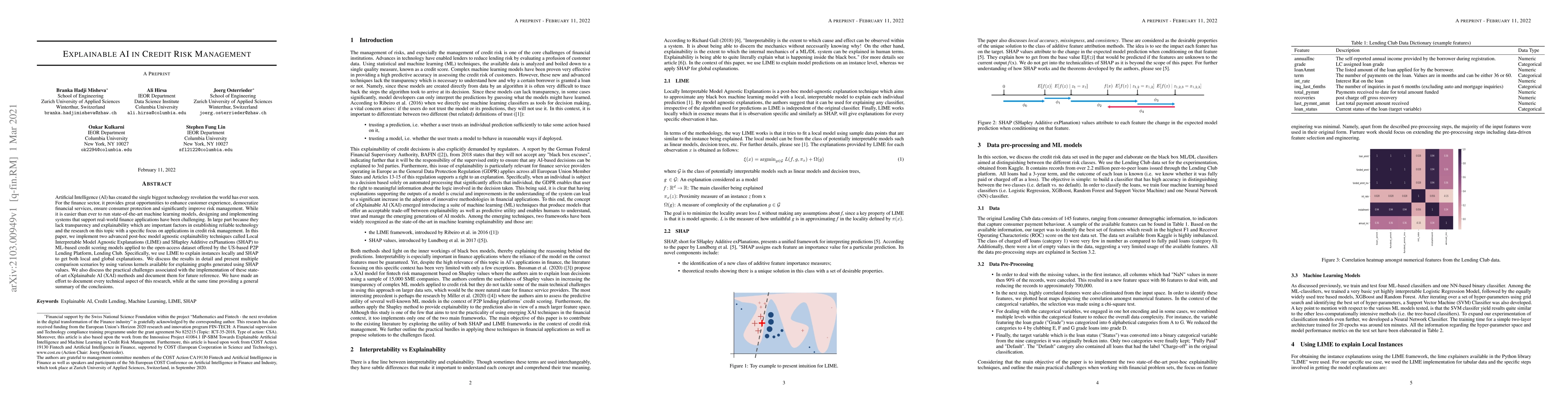

Artificial Intelligence (AI) has created the single biggest technology revolution the world has ever seen. For the finance sector, it provides great opportunities to enhance customer experience, democratize financial services, ensure consumer protection and significantly improve risk management. While it is easier than ever to run state-of-the-art machine learning models, designing and implementing systems that support real-world finance applications have been challenging. In large part because they lack transparency and explainability which are important factors in establishing reliable technology and the research on this topic with a specific focus on applications in credit risk management. In this paper, we implement two advanced post-hoc model agnostic explainability techniques called Local Interpretable Model Agnostic Explanations (LIME) and SHapley Additive exPlanations (SHAP) to machine learning (ML)-based credit scoring models applied to the open-access data set offered by the US-based P2P Lending Platform, Lending Club. Specifically, we use LIME to explain instances locally and SHAP to get both local and global explanations. We discuss the results in detail and present multiple comparison scenarios by using various kernels available for explaining graphs generated using SHAP values. We also discuss the practical challenges associated with the implementation of these state-of-art eXplainabale AI (XAI) methods and document them for future reference. We have made an effort to document every technical aspect of this research, while at the same time providing a general summary of the conclusions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)