Summary

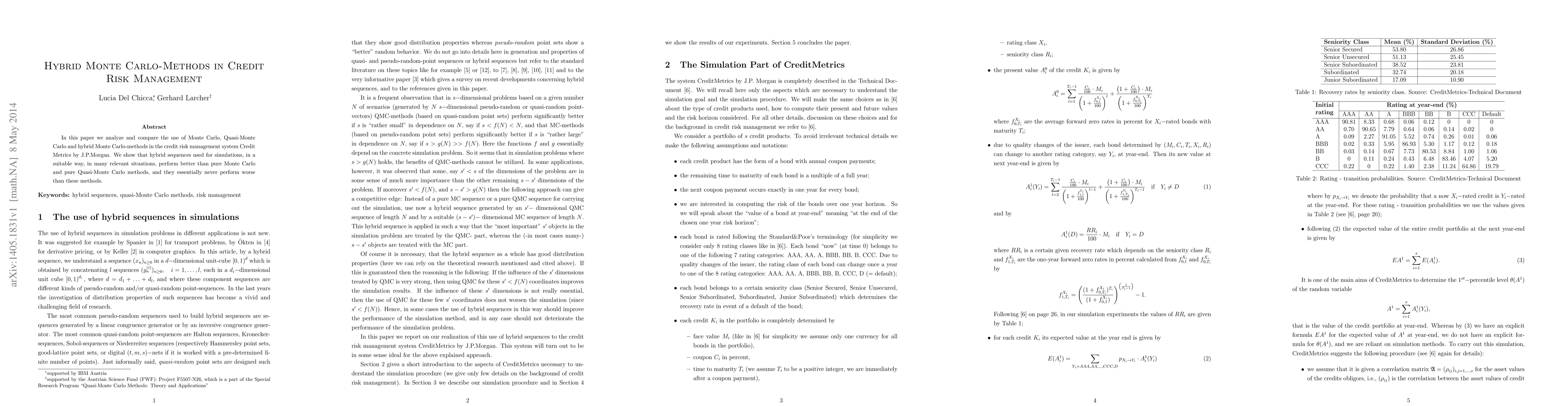

In this paper we analyze and compare the use of Monte Carlo, Quasi-Monte Carlo and hybrid Monte Carlo-methods in the credit risk management system Credit Metrics by J.P.Morgan. We show that hybrid sequences used for simulations, in a suitable way, in many relevant situations, perform better than pure Monte Carlo and pure Quasi-Monte Carlo methods, and they essentially never perform worse than these methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)