Authors

Summary

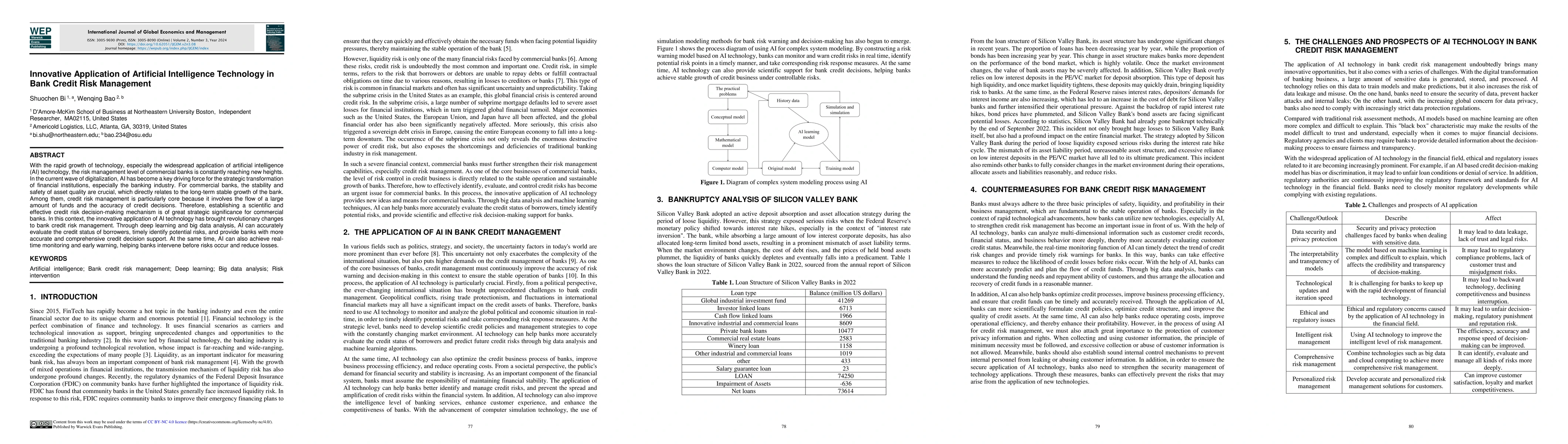

With the rapid growth of technology, especially the widespread application of artificial intelligence (AI) technology, the risk management level of commercial banks is constantly reaching new heights. In the current wave of digitalization, AI has become a key driving force for the strategic transformation of financial institutions, especially the banking industry. For commercial banks, the stability and safety of asset quality are crucial, which directly relates to the long-term stable growth of the bank. Among them, credit risk management is particularly core because it involves the flow of a large amount of funds and the accuracy of credit decisions. Therefore, establishing a scientific and effective credit risk decision-making mechanism is of great strategic significance for commercial banks. In this context, the innovative application of AI technology has brought revolutionary changes to bank credit risk management. Through deep learning and big data analysis, AI can accurately evaluate the credit status of borrowers, timely identify potential risks, and provide banks with more accurate and comprehensive credit decision support. At the same time, AI can also achieve realtime monitoring and early warning, helping banks intervene before risks occur and reduce losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Management for Distributed Arbitrage Systems: Integrating Artificial Intelligence

Akaash Vishal Hazarika, Mahak Shah, Swapnil Patil et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)