Authors

Summary

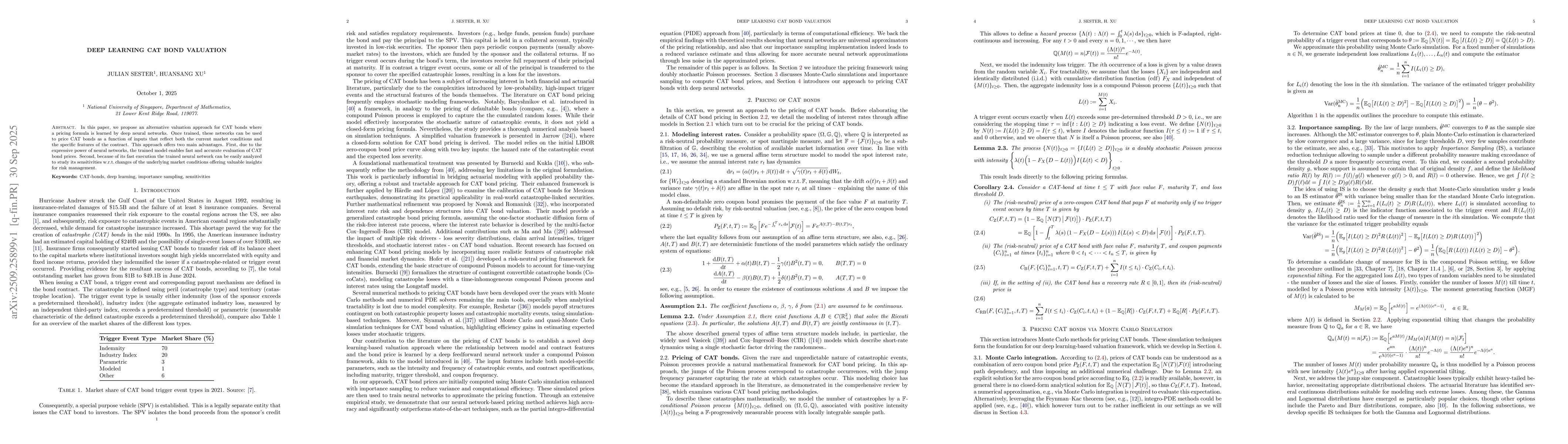

In this paper, we propose an alternative valuation approach for CAT bonds where a pricing formula is learned by deep neural networks. Once trained, these networks can be used to price CAT bonds as a function of inputs that reflect both the current market conditions and the specific features of the contract. This approach offers two main advantages. First, due to the expressive power of neural networks, the trained model enables fast and accurate evaluation of CAT bond prices. Second, because of its fast execution the trained neural network can be easily analyzed to study its sensitivities w.r.t. changes of the underlying market conditions offering valuable insights for risk management.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a combination of mathematical modeling, importance sampling techniques, and deep learning approaches to price catastrophe bonds. It integrates affine term structure models with compound Poisson processes to capture extreme risk events, while neural networks are used for approximating complex pricing functions.

Key Results

- Development of a robust framework for pricing catastrophe bonds using affine models and importance sampling

- Demonstration of neural networks' effectiveness in approximating complex cat bond pricing functions

- Establishment of continuity properties for cat bond pricing functions with respect to model parameters

Significance

This research provides a comprehensive approach to catastrophe bond valuation that addresses both traditional financial modeling and modern machine learning techniques. It offers practical tools for risk management and pricing in the insurance and finance sectors.

Technical Contribution

The paper makes significant contributions by establishing continuity properties of cat bond pricing functions, developing efficient importance sampling algorithms for extreme risk events, and demonstrating the viability of neural networks for complex financial derivative pricing.

Novelty

This work is novel in its integration of affine term structure models with compound Poisson processes for catastrophe risk modeling, and in applying deep learning techniques to approximate cat bond pricing functions while maintaining analytical rigor.

Limitations

- The deep learning approach requires extensive training data which may not be readily available for rare catastrophe events

- Importance sampling methods can suffer from variance issues in complex models

Future Work

- Exploring hybrid models that combine analytical solutions with machine learning approximations

- Investigating the application of reinforcement learning for dynamic cat bond portfolio management

- Extending the framework to incorporate climate change risk factors

Paper Details

PDF Preview

Similar Papers

Found 4 papersScalable Property Valuation Models via Graph-based Deep Learning

Enrique Riveros, Carla Vairetti, Christian Wegmann et al.

Comments (0)